NJ Bridgewater

5 December 2018

Introduction: Money & The Digital Age

|

| Raw hex version of the Genesis block, 1/3/09 |

|

| The Times, 1/3/09 |

Money is power, and power is energy. Energy is the basis of

all existence.

In my

previous article, I discussed the history of money and its origins,

and I have also written on the

history of wealth in general. The origins of money and

wealth go back to the origins of humanity itself – to the earliest societies

which used shells as a form of proto-money. This was eventually substituted

with precious metals, such as electrum, silver and gold. The Lydians began to

mint electrum, silver and gold coins with a standard weight and shape, and this

innovation was adopted by the Greeks and Persians. The Chinese then invented

paper “money” – the first truly fiat currencies – all of which failed and were

reduced to a value of zero. Now, in the 20th and 21st

centuries, we have again experimented with fiat currencies, both in paper and

digital form, with the majority of currencies being more than 80% or 90%

digital. This has coincided with what is called the dawn of the Information

Age. The Industrial Revolution began in Britain sometime around 1760 and ended

in about 1840. This was

followed by the Second Industrial Revolution, also called the Technological

Revolution, which started in 1870 and ended in 1914, with the start of the

First World War. The Digital Revolution, also called the Third Industrial

Revolution, began sometime in the 1950s and has continued to the present day,

coinciding with the Information Age, the Digital Age or the Computer Age.

This age is characterised by a shift from industrial production to information

technology and computerization.

|

| A ledger from 1828 |

A digital age requires digital money – but here we must make

a clear distinction. As I explained in my previous article on the History of

Money, there is a huge distinction between money and currency. Money functions

both as a store of value and as a means of exchange, because it is able to

retain purchasing power over time. Gold and silver, being scarce, durable and

desirable, are able to serve as stable stores of value (SoV) over time. As

money, in the form of coins and bullion, gold and silver can also be used as a

means of exchange (MoE), meaning that they can be used to exchange value.

Precious metals are not merely arbitrary materials. They are limited in supply

and take a great deal of energy to produce. They must be mined, collected and

refined, melted down and minted into coins, bars or ingots. These, in turn, are

exchanged for objects which take time and energy to produce or labour, which is

also energy. Money thus serves as a means to transfer energy from one

individual to another. Currency also takes a certain amount of energy to

produce, being printed on paper notes/bills or as ones and zeros on a digital

database. It takes energy to maintain such databases and to process payments

via existing payment systems, such as SWIFT, PayPal, VISA and MasterCard. The

difference, however, is that existing currencies, all of which are “fiat”

currencies (i.e. created by government decree), represent a certain value but

do not work as stores of value. Why is that? Why aren’t digital or paper U.S.

dollars a store of value?

The main reason is that there is no limitation on the number

of modern U.S. dollars which can exist. The Spanish dollar, which was made of

silver, was naturally limited by the supply of silver on Earth. Since silver is

naturally scarce, Spanish dollars were also scarce, meaning that the supply of

Spanish dollars could not be artificially inflated. This means that it was not

a fiat currency, but real money. The value of the Spanish dollar was also

dependent on the market value of silver, meaning that it was sound money. The

value of sound money is not determined by governments – rather, it is

determined by the free market. Fiat currencies can be manipulated by the

creation of nominal values which do not match real-world assets or purchasing

power. A U.S. dollar isn’t pegged to any scarce asset, like gold, so it isn’t

scarce. Furthermore, as the number of U.S. dollar bills increases, its value

decreases, leading to inflation and depreciation. As Polleit (2010) argues in

an article on ‘The Curse of Fiat Money’, “the inflated money stock cannot be

brought back toward any rightful level, as fiat money is created out of thin

air via circulation credit, not backed by any commodity” meaning that “there is

no equilibrium level the fiat-money supply could shrink toward”.

The value of a silver dollar, however, would reflect an increase or decrease in

the supply of silver, with the discovery of new silver mines being the only way

to increase the supply. Sound money, therefore, does reach an equilibrium,

which is based on a natural supply limit. For money to work as a store of

value, it has to be limited.

Digital Money & Economics

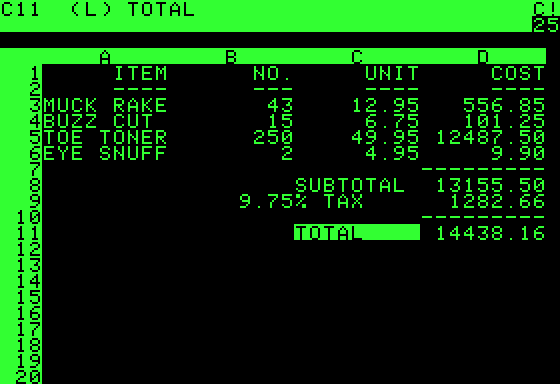

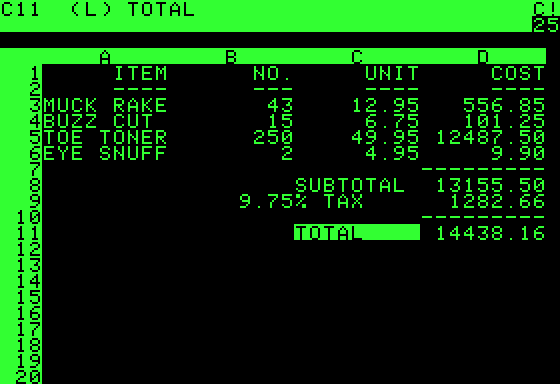

VisiCalc spreadsheet on an Apple II

VisiCalc spreadsheet on an Apple II

How can scarcity of money be ensured in a digital age?

Nowadays, U.S. dollars can be created at the flick of a button. Even printing

has largely been rendered obsolete, as the vast majority of fiat currency in

circulation is 100% digital – ones and zeros on a bank’s spreadsheet. In fact,

most of it isn’t even created by the Federal Reserve. Whenever banks extend

loans to non-banks, e.g. consumers or businesses, they increase the money

supply through what Mises calls ‘bank-circulation credit’ – a practice which

results from fractional reserve banking.

This is where banks lend out more currency than they have in reserve. They are,

quite literally, creating currency out of thin air. The result of all this is

that the money supply is constantly being increased, reducing the purchasing

power of ordinary consumers. Since the digital world is a limitless expanse,

and computer memory and computing power grows year-by-year according to Moore’s

law, the potential supply of currency is ultimately limitless. That is not good,

as it means that people cannot reliably save money. If they cannot save money,

they cannot build up the capital needed to start businesses, buy/build a house

and improve their standard of living. This results in social stagnation and a

lack of upward mobility. The frustration felt by many millennials in the early

21

st century, who are unable to afford to buy a house or live on a

single income is a reflection of the deleterious effects of relying on fiat

currencies.

It is urgent, therefore, for a new sound money to come into

existence. Since governments are unlikely to willingly give up their power to

create currency out of thin air, and fractional reserve banking isn’t going

anyway anytime soon, perhaps the free market could provide a solution—and it has.

“The idea of sound money,” Ludwig von Mises informs us, “was devised as an

instrument for the protection of civil liberties against despotic inroads on

the part of governments,” is “affirmative in approving the market's choice of a

commonly used medium of exchange,” and “is negative in obstructing the

government's propensity to meddle with the currency system”.

Money must, furthermore, be created by free-market forces, Mises argues, rather

than government interventionism.

Money itself is, he further argues, a commodity. In a free market, money is the

commodity which is most exchangeable.

In other words, if the most exchangeable commodity are shells, then shells are

money. If shekels of gold or silver are the most exchangeable commodity, then

these too are money. What counts as money will vary over time, but, ultimately,

the free market will decide what becomes money, and that money is

simultaneously a commodity, a store of value and a means of exchange. It would

be a mistake, however, to assume that money must be material. As Michael

Goldstein argues, the idea that money must be a physical, tangible good made

sense up until 2009, as there did not previously exist any form of digital

scarcity.

Today,

he argues, we “do have at least one viable digital commodity, and it also

happens to be very useful for the purposes of money”, i.e. Bitcoin.

[For an introduction to Bitcoin, see my article(s) entitled

‘What

is Bitcoin?’]

The CypherPunks and the Origins of Digital Money

|

| Taxonomy of money |

If we want to look to the origins of digital money and the

genesis of Bitcoin, we have to look a few decades before its actual emergence

in 2009. Bitcoin, as we know, was invented in 2008 when someone under the

pseudonym Satoshi Nakamoto published a paper entitled “Bitcoin: A Peer-to-Peer

Electronic Cash System”.

According to Andreas M. Antonopoulos, Nakamoto’s innovation combined several

previous inventions such as b-money and HashCash to create a new decentralized

electronic cash system, using a Proof of Work algorithm, which was a form of

distributed computation system.

In 2010, Satoshi Nakamoto himself wrote that “Bitcoin is an implementation of

Wei Dai's b-money proposal http://weidai.com/bmoney.txt on Cypherpunks

http://en.wikipedia.org/wiki/Cypherpunks in 1998 and Nick Szabo's Bitgold

proposal http://unenumerated.blogspot.com/2005/12/bit-gold.html”.

The immediate antecedents of Bitcoin, therefore, are known: HashCash (proposed

by Adam Back, 1997), b-money (proposed by Wei Dai, 1998) and Bitgold (Nick

Szabo, 1998). Moreover, in 2004, computer scientist Hal Finney developed the

first reusable proof of work system called, quite simply, ‘Reusable Proof of

Work’ (RPOW), which was based on Nick Szabo’s ‘theory of collectibles’.

This

theory is outlined in Szabo’s essay on the origins of money, published in 2002,

which explained that the earliest forms of proto-money in ancient societies

were collectibles, and these enabled early humans to solve problems related to

reciprocal altruism, kin altruism and mitigation of aggression.

Like Mises, Szabo does not regard money as some arbitrary creation of governments.

Rather, it has deep evolutionary and societal roots. The earliest proto-money

or primitive money, as used by hunter-gatherer tribes, differs significantly

from modern money, so he chose to refer to it as a ‘collectible’ or ‘valuable’.

These collectibles, according to Szabo, were “low velocity money, involved in a

small number of high value transactions” whereas coins were “high velocity

money, facilitating a large number of low value trades”.

The philosophical and theoretical origins of Bitcoin, indeed,

are best described by Nick Szabo, the inventor of smart contracts, who seems to

also be the originator of the economic theory and philosophy behind Bitcoin. He

has delivered several talks on the topic of the History of Blockchain (at the

Ethereum Developer Conference, November 9

th – 13

th,

2015), and the Origins & Future of Bitcoin (at the Bitcoin Investor

Conference, Las Vegas, NV, Oct. 29 – 30, 2015).

According to Szabo, Bitcoin (and blockchain) has its origins in libertarianism

and the need to create privatised money. This money, by nature, requires trust

minimization, or trustlessness, as trusted strangers are ‘security holes’. In

his talk on the Origins of Bitcoin, Szabo discusses the Bit gold proposal, stating:

“Bit gold was pretty much a

transparent attempt to say, let’s take the properties of gold – the economic

properties of gold – such as unforgeable costliness, but let’s improve the

security properties of it… gold has been very insecure – the Spanish looted the

Aztecs, the English looted the Spanish, FDR confiscated gold – there’s a lot of

situations where gold was not secure enough to use, and so the idea was to use

a tool from computer science to come up with something better. And so, we can

look at when Satoshi came out with Bitcoin, there’s a lot of parallels between

that and b-money and Bit gold – it makes it distinct from the traditional

financial system which did not, for the most part, use these advanced principles

of computer science.”

Due to Bitcoin’s trustlessness, he further argues, Bitcoin

serves a number of purposes including: business-to-business transactions (B2B),

remittances, routes around capital controls and, interestingly, potential to

serve as a reserve currency. In fact, he states:

“This one hasn’t been used for yet

but is something which I envisioned when I was thinking of Bit gold – it’s

something you can still do with Bitcoin – it’s that governments and banks can

use it as a reserve currency. Political distrust arises when wars break out;

it’s going to be a lot more secure for them to be holding cryptocurrency than

to be holding gold – and especially because much of the world’s gold is held in

trust in the United States anyway.”

In his talk at the Ethereum Developer Conference in 2015,

Nick Szabo describes two key figures as important “political and philosophical

inspirations” behind the Cypherpunk movement: Ayn Rand and Friedrich Hayek. In

particular, Russian-American philosopher and writer Ayn Rand (1905 – 1982) created

the concept of ‘Galt’s Gulch’, which was a place where individuals could come to

together and form their own community independent of corrupt institutions and

society. This idea was taken up by Tim May, who conceptualised the concept of

‘Galt’s Gulch’ within cyberspace, which would be protected by cryptography. Austrian

economist Friedrich August von Hayek (1899 – 1992), likewise, was influential

in the economics behind Cypherpunk movement. The Cypherpunks traced their

technical roots, furthermore, to the ideas of cryptographer David Chaum, who wrote

about anonymous digital cash and pseudonymous reputation systems in a paper

titled "Security without Identification: Transaction Systems to Make Big

Brother Obsolete" (1985).

In this monumental paper, Chaum writes that “large-scale automated transaction

systems of the near future can be designed to protect the privacy and maintain

the security of both individuals and organizations” through the use of ‘digital

pseudonyms’ created through “a special random process”.

The Cypherpunk movement, inspired by these ideas, began to take shape in the

early 1990s when Eric Hughes, Timothy C. May and John Gilmore began to meet

monthly at Gilmore’s Company Cygnus Solutions in the San Francisco Bay area.

Jude Milhon, who attended one of their early meetings, coined the phrase

‘cypherpunk’ as a combination of the words cipher and cyberpunk, and the word

was added to the Oxford English Dictionary in 2006.

|

| DigiCash |

Far from being merely theoretical, however, there were

attempts, in the early 1990s, to bring an electronic cash system into

existence. Chaum had originally conceived of ‘Ecash’, a form of cryptographic

electronic money (or ‘cryptocurrency’), back in 1982, but this did not take

form until he founded his DigiCash company in 1990, raising $10 million.

The new Ecash was tested in only one bank, the Mark Twain Bank in Saint Louis,

MO, using it as a micropayment system. Five thousand customers used the Ecash

system over a three-year period from 1995 to 1998, when it was dissolved.

This coincided with the bank being purchased by Mercantile Bank, a large issuer

of credit cards.

Ecash’s

demise was followed, in 1998, by Wei Dai’s proposed b-money and Nick Szabo’s Bit

gold proposal, the latter of which would require users to complete a proof of

work function, in which a cryptographic puzzle had to be solved in order to

release new currency, rather like Bitcoin does today.

One of the key distinguishing features, however, between Wei Dai’s proposal and

Szabo’s is the notion of a fixed supply. Wei Dai was interested in “Tim May’s

crypto-anarchy”, in which “the government is not temporarily destroyed but

permanently forbidden and

permanently unnecessary”. His proposal was not interested in

the scarcity of money. As in Bitcoin, he argued that “anyone can create money

by broadcasting the solution to a previously unsolved computational problem”.

However, “the number of monetary units created is equal to the cost of the computing

effort in terms of a standard basket of commodities”, so that, “if a problem

takes 100 hours to solve on the computer that solves it most economically, and

it takes 3 standard baskets to purchase 100 hours of computing time on that

computer on the open market, then upon the broadcast of the solution to that

problem everyone credits the broadcaster's account by 3

units”. While this ties b-money to real-world baskets of goods, it potentially

allows for a continuous and uncapped supply of currency.

|

| Wei Dai (b-money) |

Szabo’s Bit gold proposal, however, outlined something that

was not merely a “a payment scheme, but also as a long-term store of value

independent of any trusted authority”, comparing and contrasting it to “the

properties of traditional stores of value based on verifiable scarcity, such as

precious metals and rare collector's items”.

In

other words, Bit gold was not intended merely as a payment system, like PayPal

or MasterCard. On the contrary, payment systems are conventional systems used

by companies and banks to transfer currency from one customer or business to

another, or from one bank to another bank. Such systems can always be made more

efficient, or more decentralised, but that is completely beside the point.

Attempts have already been made to do just that, including the creation of the

Ripple cryptocurrency, also called XRP, which was created by Ripple Labs, Inc.

While the technology behind Ripple (XRP) might be innovative, it fails as sound

money, and this is because, first and foremost, it is a corporate

cryptocurrency. Initially, some 100 billion Ripple (XRP) were created, with 20

billion XRP being retained by the founders, and the remaining 80% being held by

Ripple Labs. By 2015, Ripple Labs still retained some 67% of their original

80%, and, in May 2017, they placed 55 billion XRP (88% of their holdings) into

a cryptographically-secured escrow. Due to its hyper-centralization, therefore,

XRP lacks trustlessness, and its fate is intimately tied to that of the company

behind it. Bit gold’s purpose was entirely different – to serve as a trustless,

decentralised digital gold and settlement layer which did not rely on any

trusted third party. Bit gold could not be confiscated, stolen or hacked – and

it was to have all the properties of gold which make it sound money, i.e. value

determined by the free market, durability, scarcity, verifiability and

fungibility.

|

| Nick Szabo (Bit gold, smart contracts) |

Bit gold was never implemented with its original name, but

the philosophy behind it, and the innovations which it proposed, were later

incorporated into a more developed and mature cryptocurrency, i.e. Bitcoin.

Bitcoin, like Bit gold, was not merely a new payment system. It was designed

quite specifically to function as both a means of exchange and a store of

value, enabling it to serve as a form of digital gold. By 2008, after some ten

years of studying the problem, Szabo’s proposal was ready to be implemented,

but who would take up the task? In a comment to a blog post he wrote entitled

“Bit gold markets” (December 27, 2008), he wrote: “To be useful both gold and

bit gold have to end up saving users more in transaction costs than is expended

in the gold mining or the CPU running. They both save transaction costs by

serving as stores of value and media of exchange, or as backing for fractional

reserve currencies that do same, but bit gold will perform these monetary

functions with greater security, lower storage costs, etc. than gold… Anybody

want to help me code one up?”

A

few months earlier, on the 18

th of August 2008, the domain name

bitcoin.org was registered, and, on the 31

st of October 2008,

Satoshi Nakamoto’s Bitcoin whitepaper, “Bitcoin: A Peer-to-Peer Electronic Cash

System”, was published on a cryptography mailing list.

A

few days later, on the 3

rd of January 2009, the Bitcoin protocol was

launched as Satoshi Nakamoto mined the genesis block (block number 0), creating

the first 50 Bitcoins.

Whether or not Szabo was involved in the creation of Bitcoin, Satoshi did

credit him, writing that “Bitcoin is an implementation of Wei Dai's b-money

proposal… and Nick Szabo's Bitgold proposal”, leading one to the conclusion

that Bitcoin is a direct development of Bit gold.

The Bitcoin Whitepaper

Bitcoin has two birthdays, in a sense. One is the date that

the whitepaper was published: 31 October 2008 – and the other is when the first

block – the Genesis Block – was mined, on 3 January 2009. The latter is more

generally accepted as the birth of Bitcoin, as this is the date that the

Bitcoin network launched. The Bitcoin whitepaper was the promise, and the

Genesis block was the fulfilment. For Bitcoin and BCH-believers alike, the

whitepaper has become a gospel of sorts, as it lays out the original vision of Satoshi

Nakamoto. It must be remembered, however, that a whitepaper is a visionary

document, but it is not infallible, nor can it foresee all the problems or

complications that may arise when a protocol is actually launched. The

whitepaper, indeed, is formative, but it must also be compared to the actual

Bitcoin protocol, as well as the many other e-mails and correspondence of

Satoshi Nakamoto, in order to gain a more holistic view of his original vision

and purpose. In the whitepaper, Nakamoto sets out a technical description of how

Bitcoin would function, as well as the problem that it was aiming to solve, and

how it solves that problem. That problem is trusted third parties. He writes

that the current financial system works well for most transactions, but, “it

still suffers from the inherent weaknesses of the trust based model”, as well

as the cost of “mediation” through third parties. Furthermore, truly “non-reversible

transactions” are not possible with the existing financial system.

What this means it that banks and financial institutions act as third parties,

who have control over the eventual fate of our transactions. They can cancel or

reverse a transaction, and they must act as trusted third parties. That trust,

all too often, proves misplaced, as banks sometimes go insolvent, or governments

can use banks to confiscate money, as in the case with Cyprus in 2012-2013. The

financial crisis of 2008, in which governments had to bail out failed banks,

was also instructive, and, no doubt, may have inspired Satoshi to release his

whitepaper and the Bitcoin protocol.

The solution? Satoshi Nakamoto proposed “an electronic

payment system based on cryptographic proof instead of trust, allowing any two

willing parties to transact directly with each other without the need for a

trusted third party”, protecting “sellers from fraud”, while allowing “routine

escrow mechanisms” to protect buyers. He also proposed a solution to the “double-spending

problem” through the use of “a peer-to-peer distributed timestamp server to

generate computational proof of the chronological order of transactions”.

The

solution referred to is now commonly called the blockchain. Double-spending is

when digital transactions allow the same money or units of account to be spent

twice. This is not a problem for physical cash, as one cannot spend the same metal

coins or notes twice. With digital transactions, however, the problem was how

to ensure that a digital ledger could be verifiable. The blockchain solves this

by creating an immutable ledger which cannot be changed. This is ensured through

a distributed network in which numerous nodes, i.e. computers which each have a

copy of the entire list of transactions, each update a distributed ledger

whenever new transactions are added. Transactions are bundled together in a

block, which does not record the names or details of the people making the

transactions. Rather, each person has a digital address, and the transactions from

each address are bundled together within each block. That block is then “mined”.

This is the process called ‘proof of work’.

There is an algorithm called SHA-256 (SHA stands for ‘Secure

Hash Algorithm’). This algorithm is a mathematical operation run on digital

data: as computers compare the computed ‘hash’, i.e. the output from executing

the algorithm, to a known or expected hash value, the integrity of a set of data

can be determined. This takes a certain amount of computing power to complete,

and the computer which completes it generates a block on the blockchain and

receives what is called the ‘mining reward’. Initially, this was set at 50

Bitcoins. Each block is linked to the block which comes after it, forming a chain

of blocks that cannot be altered. Each node is a computer which stores a

complete copy of the Bitcoin blockchain and runs the Bitcoin protocol. Since

these nodes are distributed across the entire planet, there is no way for

transactions to be falsified or deleted. Each new block is mined by running the

same SHA-256 algorithm, and each new mining reward incentivises miners to

continue running the blockchain and verifying transactions. This ensures that double

spending cannot occur, as each transaction can be independently verified using

a blockchain explorer, and the computing power necessary to falsify the blockchain

would be so immense, and the rewards so low for doing so, that such a falsification

is well-nigh impossible. Indeed, as mining difficulty increases, and the size

of the network grows, the security of the network grows in tandem. Thus Satoshi

wrote that “a key aspect of Bitcoin is that the security of the network grows

as the size of the network and the amount of value that needs to be protected

grows.”

A Bitcoin is not simply an arbitrary 1 or 0 in a digital

ledger. That, more correctly, would be what U.S. dollars or Euros are. They are

merely 1s and 0s stored in a bank’s ledger, and are subject to hacking, manipulation

or deletion. Transactions of dollars can be easily reversed or stopped because

they just represent data, which is not tied to or controlled by any kind of

irreversible or immutable protocol. An individual Bitcion, however, according

to the Bitcoin whitepaper is “a chain of digital signatures”, with each owner

transferring “the coin to the next by digitally signing a hash of the previous

transaction and the public key of the next owner and adding these to the end of

the coin”, with the payee being able “to verify the chain of ownership”.

This

is extraordinary, because it means that Bitcoin isn’t merely some kind of ‘magic

internet money’ or simply a set of data. Rather, each Bitcoin is a tangible

record of immutable transactions, showing the address of both the one making

the transaction and the recipient. This means that each Bitcoin carries with it

a history, and that history represents a permanent record which is verified and

maintained through a network of countless thousands of nodes distributed across

the planet. Even if all the nodes in one country are destroyed, the blockchain

will remain secure, as it is distributed widely throughout the entire world.

Each node is maintaining that tangible history, and each coin is secure from

fraud, hacking or deletion. A U.S. dollar, being a simple 1 on a database, can

be instantly deleted or created out of thin air. If a bank disappears tomorrow,

so do all of its transactions, and so does the credit and debt which that bank

created, resulting in a contraction of the money supply. U.S. dollars are

really quite ephemeral – created out of thin air and as easily destroyed.

Bitcoin is a history, and that history is preserved and maintained through computing

power and energy. Like gold, it takes energy to produce, and it takes energy to

keep it secure. Bitcoin has, in other words, inherent value.

The Genesis Block

We have already briefly looked at what a block is. Satoshi

explains the process of running the Bitcoin network as follows: “1) New

transactions are broadcast to all nodes. 2) Each node collects new transactions

into a block. 3) Each node works on finding a difficult proof-of-work for its

block. 4) When a node finds a proof-of-work, it broadcasts the block to all

nodes. 5) Nodes accept the block only if all transactions in it are valid and

not already spent.

6) Nodes express their acceptance of the block by working on

creating the next block in the

chain, using the hash of the accepted block as the previous

hash.”

This is, in simple terms, what Bitcoin does. All of these new blocks trace back

to the previous block, and each block traces back, ultimately, to the Genesis

Block. They are all beads on a string, so to speak, and they all go back to the

first bead on that string. The Genesis Block contained a message within the ‘coinbase’,

i.e. the content of the input of a generation transaction.

The coinbase can contain any arbitrary data and, in this case, Satoshi included

the title of an article from the Times of London: “The Times 03/Jan/2009

Chancellor on brink of second bailout for banks.”

This, in a nutshell, spelled out the reason for Bitcoin’s existence. The

Chancellor refers to the Chancellor of the Exchequer in the United Kingdom, who

is responsible for delivering the budget of the United Kingdom Government

during any fiscal year. The 2008 financial crisis had brought the Western world

and the world economy to the brink of financial collapse. Instead of letting

the free market repair itself, as they should have done, and allowing natural

selection to eliminate banks that were ‘too big to fail’, governments swooped

in and propped up failed institutions and a failing system through bank

bailouts, thus furthering national debt and ensuring that the burden thereof would

be shifted to future generations. The financial system had failed, and Bitcoin

was the answer.

One of the key ways in which Satoshi aimed to solve this

problem was through the creation of digital scarcity. In the real world, assets

are scarce, as they are limited by Nature. There is only so much arable or

fertile land on Earth, and there is only so much gold and silver. There is also

only so much time that each person has within one lifetime. Everything which is

scarce and value, indeed, may be counted as an asset. Governments and financial

systems wreck this natural order by creating unlimited amounts of debt and

credit, and through the printing of a limitless number of banknotes. Based on

Nick Szabo’s Bit gold concept, Satoshi incorporated the notion of digital

scarcity by limiting the possible number of Bitcoins which could ever be

created. In an e-mail he wrote that, initially, he originally wanted to make prices

(of Bitcoins) “similar to existing currencies”, but, since he did not know the

future, that would be very hard. Instead, he chose a middle path, with the

total number neither being too small nor too high – a fixed amount of 21

million BTC.

This

would either result in a Bitcoin price that would be very low, if it remained “a

small niche”, or “if you imagine it being used for some fraction of world

commerce, then there’s only going to be 21 million coins for the whole world,

so it would be worth much more per unit”, with each coin being divisible to “8

decimal places, so 1 coin is represented internally as ‘100000000’”. This, Satoshi

argued, gives Bitcoin “plenty of granularity if typical prices become small”.

When asked about why 21 million was chosen as the limit, Satoshi reiterated: “I

wanted something that would be not too low if it was very popular and not too

high if it wasn't.”

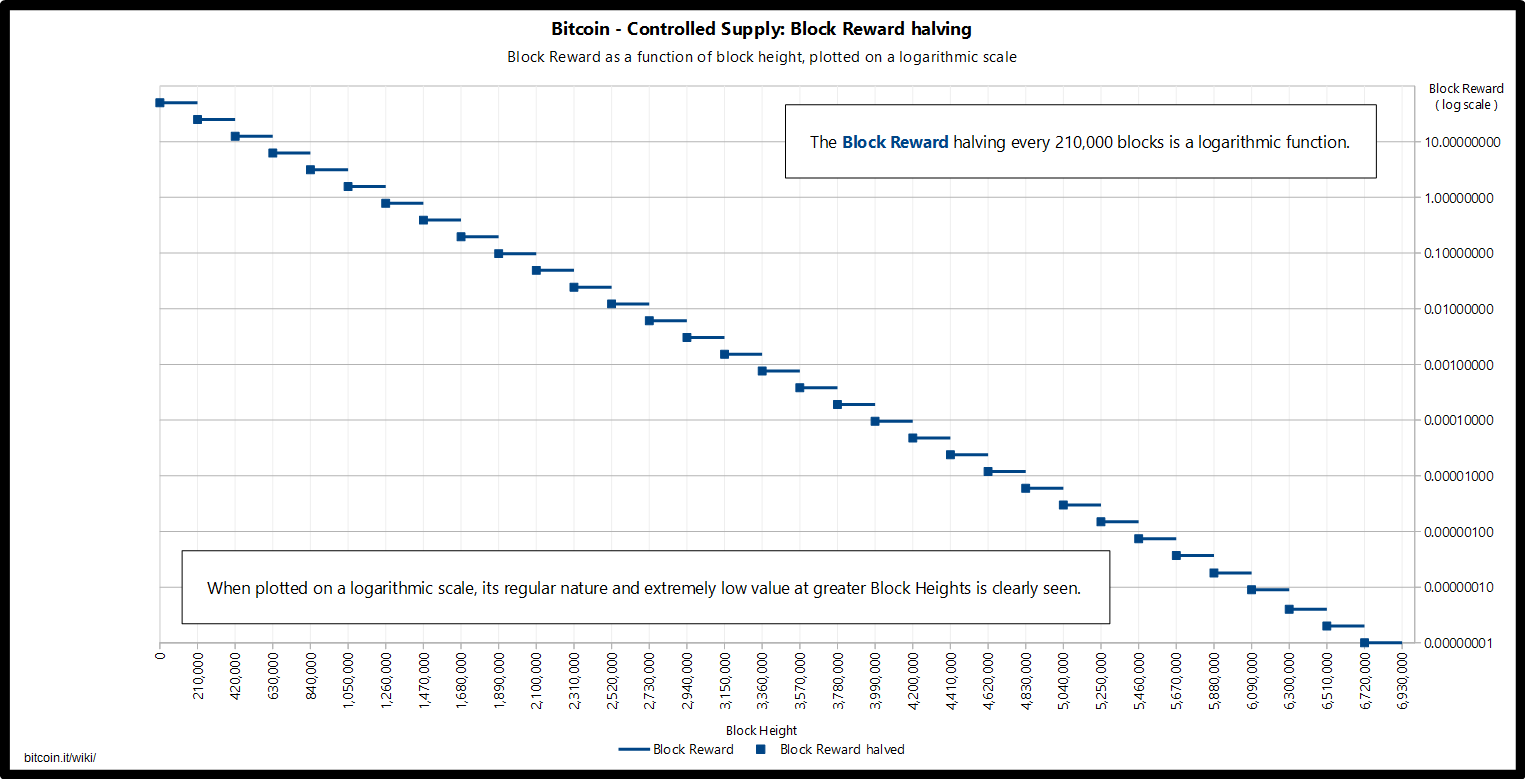

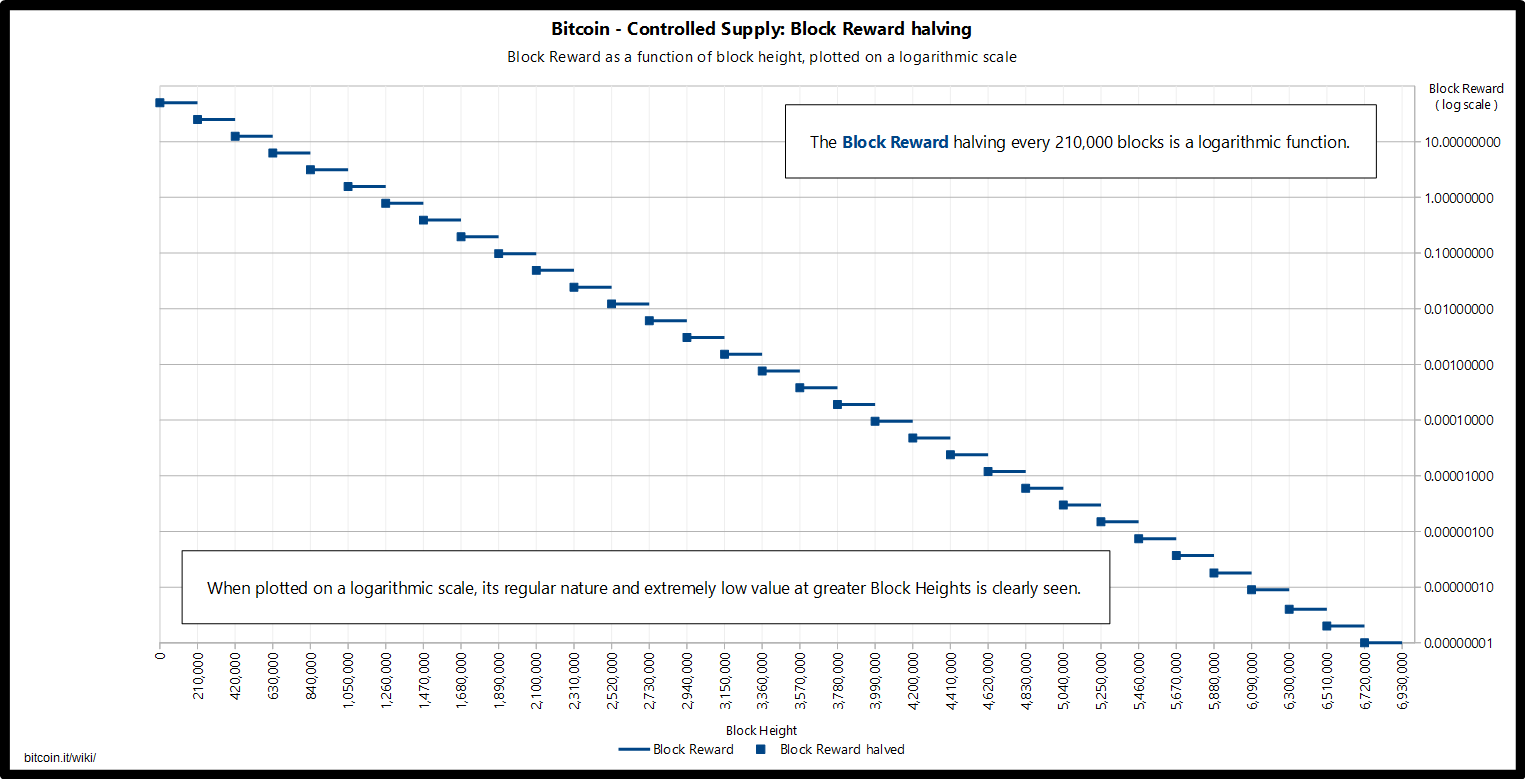

|

| Bitcoin – controlled supply |

Deflation and Price

Other key features were added to Bitcoin at its very

beginning. These were explained by Satoshi in various e-mails, having not been clarified

in the original Bitcoin whitepaper. For example, each block takes about 10 minutes,

with the initial mining reward set at 50 BTC. However, he also introduced

something called the ‘the halving’. This is the halving of the Bitcoin mining

reward every 210,000 blocks, “or around 3.9954 years, which is approximate

anyway based on the retargeting mechanism's best effort”.

Thus,

the first halving happened, as programmed, on November 28, 2012, when block

210,000 was solved, and the mining reward dropped from 50 BTC to 25 BTC.

Before

the halving, some 10.5 million BTC had already been mined, which is 50% of the

maximum total supply.

The

genius of creating a regular halving of the mining reward roughly every 4 years

is that it ensures that the amount of Bitcoins created halves every four years.

This means that the inflation rate of Bitcoin is cut in half every time 210,000

blocks are mined, with the supply decreasing rapidly over time, until there are

only a maximum of 21 million BTC in existence, including the first 50 BTC of the

Genesis block, which cannot be spent (either intentionally or through a fluke

of the code). On the surface, since new Bitcoins are mined every block, Bitcoin

appears to be inflationary. In reality, however, it is deflationary, and here’s

why: with Bitcoin, you can be your own bank. That means that your private key

is your responsibility. Every Bitcoin user has a public key, which allows them

to receive transactions, and a private key, which allows them to spend their

Bitcoins. Whoever holds the private key, owns the Bitcoin. Over time, people

lose their private keys, or their hard-drives get trashed and lost, and this

was particularly common in the first few years of Bitcoin history. Therefore,

as many as 4 million BTC have been lost altogether, or between 2.78 and 3.79

million, representing 17 – 23% of existing Bitcoins.

Thus

while, by 2017, there were roughly 16.381 million BTC in existence, some 3.789

were potentially lost, resulting in a supply of about 12.592 million BTC.

|

| Bitcoin transactions (January 2009 – September 2017) |

In addition to lost coins, which increase the value of

circulating Bitcoins, the halving of the mining reward has a notable effect on

the value of each Bitcoin. Bitcoin started off at basically nothing, until, by

March 2010, it was selling on BitcoinMarket.com for about $0.003, or less than

1 U.S. penny.

By July

2010, it had reached about 8 cents, and, between February and April 2011, it

reached parity with the U.S. dollar.

This

brought increased interest in the new currency, with the first speculative

bubble resulting in an all-time-high of $31 on the 8

th of July 2011,

followed by a crash to $2.

Twelve

months after the first Bitcoin halving event in November 2012, the Bitcoin

price reached an all-time-high of $1000 USD.

Since this represented market hype and speculation, of course, the price bubble

popped, and Bitcoin fell hundreds of dollars in value. Nevertheless, regardless

of the various speculative bubbles and market cycles which Bitcoin is subject

to, its price always rises over time. Thus, when the bubble popped in 2013,

Bitcoin fell from $1000 to about $200 by March 2015.

The second Bitcoin halving occurred on July 9, 2016, when the 420,000

th

block was mined. The result? The block reward was reduced from 25 BTC to 12.5

BTC, which is the current reward (as of 2018).

Everyone

who is reading this now is probably aware of the result. By December 2017, the

Bitcoin price had risen to a startling $19,000 USD

–

something which even Satoshi himself would have found startling, if he is alive

to witness it. Of course, this resulted in a steep fall in price thereafter,

but, even now, the price of Bitcoin is above $4000. Bitcoin is subject to

speculation, but the price of Bitcoin always goes up over time, because of both

deflation, rising demand and the 4-yearly halving of the block reward.

|

| Total Bitcoin supply over time |

The next halving is only about two years away and will occur

in 2020, resulting in a reduction of the mining reward from 12.5 BTC to 6.25

BTC. This, no doubt, will result in another huge price rise followed by a price

crash to a higher low than previously. Again, the price of Bitcoin will settle

at a price much, much higher than the previous high of $19,000, meaning that

Bitcoin could be tens of thousands of dollars in value – or more. This is not written

in the spirit of prediction, but merely as an analysis of what has come before.

As these 4-yearly halvings go by, Bitcoin will continue to rise and rise in

price, eventually reaching $1 million USD – or perhaps much more. The last

Bitcoin will be mined on or about October 8

th, 2140 or May 7

th,

2140 (assuming mining power remains constant), after which transaction fees rather

than mining reward will be used to maintain the network.

However,

by the 22

nd century, only tiny fractions of a Bitcoin will be mined

at any one time. In fact, the last full Bitcoin will be mined before 2033, when

the mining reward will drop from 1.5625 BTC to 0.78125 BTC.

By that time, for mining to continue to be profitable, the price of Bitcoin

will have to be many multiples of what it is today, perhaps even $1 million USD

or several million dollars. Thomas J. Lee, head of research at Fundstrat Global

Advisors, estimates that, by the 2030s, Bitcoin could be priced at $10 million

USD.

This

may seem extraordinary, but it is well within the realm of possibility. By

2140, if the U.S. dollar still exists, one BTC would have to be worth tens or

hundreds of millions of dollars (in 2018 dollars).

|

| Bitcoin price history |

Satoshi Nakamoto – Anonymous Creator

Let us go back a second: what happened to Satoshi Nakamoto?

At the beginning, Satoshi was ever-present, answering people’s questions and

actively working on the Bitcoin protocol. So, what happened? Bitcoin began in

2009 with a small number of cryptography enthusiasts – the Cypherpunks – but it

quickly began to generate interest within a wider circle of adherents. The

first Bitcoin transaction occurred when Hal Finney was sent 10 Bitcoins from

Satoshi Nakamoto on January 12, 2009.

During the early days, Satoshi managed to mine some 1 million BTC, which have

remained mostly idle since that time. Mining required relatively little computational

power at the time, so there are many stories which arose of people losing

thousands of Bitcoins on a hard drive or forgetting/losing their private keys.

This is less likely to happen today, as Bitcoins are much, much more valuable. On

May 22, 2010, now known as Bitcoin Pizza Day, a computer developer bought two

pizzas for 10,000 BTC, which was the first commercial transaction using

Bitcoin.

This

was at a time when each Bitcoin was worth a fraction of a penny. As Bitcoin

continued to grow in price and began to gain media attention, however, it seems

that Satoshi began to become wary. He was using a pseudonym for a reason – what

he was doing was incredibly dangerous. He had created a means to liberate

mankind from the existing financial order – a financial order with vested

interests consisting of the elites and governments of the world. Satoshi’s

ideas were challenging – revolutionary – they bespoke a new world financial

order in which everyone could be their own bank, take control of their own

finances, and send transactions without the need for any government permission

or third party. If his identity were revealed, not only would he become

personally liable to potential sanction or personal danger, but it could also

potentially endanger the nascent movement itself, as he was central to the

original process of designing, implementing and improving the Bitcoin protocol.

|

| A Guy Fawkes mask |

In 2011, WikiLeaks began to accept payments in Bitcoin. WikiLeaks

was originally founded in Iceland in 2006 and has a database of some 10 million

documents collected over 10 years.

Its founder and director is the controversial figure Julian Assange, who is

currently holed up in the Ecuadorian Embassy in London, where he took refuge in

August 2012.

Assange

is currently wanted in the United States for potentially violating the Espionage

Act of 1917. As of 2017, U.S. officials were preparing to file formal charges against

Assange.

Following WikiLeaks’ release of U.S. diplomatic cables in November 2010, donations

to WikiLeaks were blocked by Bank of America, VISA, MasterCard, PayPal and

Western Union.

In 2011,

WikiLeaks turned to Bitcoin to continue accepting donations. This allowed them

to bypass the existing financial system and its limitations, allowing people to

freely choose who or what they want to support. In the same year, Freenet,

Singularity Institute, Internet Archive and the Free Software Foundation also

began accepting Bitcoin, and, as of 2012, there were over 1,000 merchants excepting

Bitcoin payments via BitPay.

In the case of WikiLeaks, accepting Bitcoin donations worked very well. By April

2012, they had collected more than 1,100 BTC in donations (then worth about $32,000,

with 1 BTC = $10.00).

That same address (1HB5XMLmzFVj8ALj6mfBsbifRoD4miY36v), now contains some 4,042.82316017

BTC, which is currently worth $15,449,365.71 USD (at $3,821.43 per Bitcoin).

For Satoshi Nakamoto, however, the controversial status of WikiLeaks was

shining an altogether-too-close a spotlight on the early Bitcoin movement. In

2010, he wrote:

“It would have been nice to get

this attention in any other context. WikiLeaks has kicked the hornet's nest,

and the swarm is headed towards us.”

The Disappearance of Satoshi Nakamoto

When did Satoshi Nakamoto finally disappear (or go quiet)? Gavin

Andresen was one of the early Bitcoin Core developers and programmers who closely

collaborated with Satoshi Nakamoto via e-mail, and, since he was a public

personality, interested parties used to look to him for information on the new

cryptocurrency.

Andresen

also went on to create the Bitcoin Foundation in 2012.

He

was also responsible for launching the first Bitcoin “faucet” in 2010, called

Bitcoin Faucet, which gave out five free Bitcoins to each visitor (it’s no

longer active, by the way).

His

collaboration with Satoshi began in earnest in December 2010, when he wrote

that, “with Satoshi’s blessing… I’m going to start doing more active project

management for Bitcoin”, being careful to assert that “I am not Satoshi

Nakamoto; I have never met him; I have had many e-mail conversations with him.”

In

2011, Gavin Andresen was asked to explain Bitcoin to the Central Intelligence

Agency (CIA), and he delivered a talk on the topic on the 15

th of

June 2011.

Before

going, Gavin informed Satoshi that he was going to visit the CIA, and Satoshi

disappeared shortly thereafter. Whether this was a coincidence or not, only

history and time will tell. Gavin explained: “The last email I sent him I

actually told him I was going to talk at the CIA. So it's possible, that.... that

may have um had something to with his deciding…”

Nevertheless,

according to Mike Hearn, who writing in 2013, Satoshi Nakamoto “communicated

with a few of the core developers before leaving. He told myself and Gavin that

he had moved on to other things and that the project was in good hands.”

Just what those “other things” were is up for debate. He did, however, send one

final message in 2014.

/2014%2F03%2F07%2Fac%2FAP407286670.05998.jpg) |

| Dorian Nakamoto |

In 2014, Newsweek, in an article entitled “The Face

Behind Bitcoin”, tried to dox Satoshi Nakamoto by identifying him with a

Japanese-American man in California called Dorian S Nakamoto,

who has since become an iconic figure within the Bitcoin movement – his,

indeed, is the face that has spawned a thousand memes. Dorian Nakamoto himself

denied being Satoshi Nakamoto, though he did have a background in financial

software. On March

8, 2014, Satoshi’s P2P Foundation account became active again and he posted one

final message: “I am not Dorian Nakamoto.”

Whether or not this was Satoshi actually posting is debatable. What is clear,

however, is that the Bitcoin creator has, for all intents and purposes,

disappeared from the public scene, and, with the exception of this brief statement

in 2014, has been inactive since about June 2011. Why did he disappear? The exact

reasons may not be known now, but the dangers of Satoshi becoming publicly

known are clear. The fate of Bernhard Von Nothaus, the creator of the Liberty Dollar,

is a telling example. The American Liberty Dollar (ALD) was a private currency

created in the United States, which took the form of minted metal rounds (i.e.

coins), gold and silver certificates and electronic currency (eLD), with actual

precious metals being warehoused at Sunshine Minting in Coeur d’Alene, Idaho.

Beginning in 1998, until it was shut down in July 2009, Nothaus’s organization,

called ‘Liberty Services’ (originally the National Organization for the Repeal

of the Federal Reserve and the Internal Revenue Code, or NORFED), issued

commodity-backed currency based on gold, silver, platinum or copper. While

not attempting to counterfeit money or create fake currency, opponents of the Liberty

Dollar argued that it was in violation of 18 U.S.C. § 486, which threatens

anyone who creates coins “intended for use as current money, whether in the

resemblance of coins of the United States or of foreign countries, or of

original design” with a fine or imprisonment of “not more than five years, or

both.”

Liberty Dollars (ALD / eLD) – A Telling Tale

|

| Liberty dollars |

As it turned out, Liberty Dollar offices were raided by the

Federal Bureau of Investigation (FBI) on November 14, 2007, seizing all the

gold, silver, and platinum, as well as two tons of ‘Ron Paul dollars’. Von NotHaus

himself was arrested on June 6, 2009 and charged with one count of conspiracy

to possess and sell coins in violation of a number of federal statues

including: 18 U.S.C. § 485, 18 U.S.C. § 486, 18 U.S.C. § 371, 18 U.S.C. § 1341,

18 U.S.C. § 2, 18 U.S.C. § 485 and 18 U.S.C. § 2.

On

March 18, 2011, he was convicted of "making, possessing and selling his

own coins", after a jury deliberated for a mere two hours. He initially

faced up to 15 years in prison, a $250,000 fine and seizure of around $7

million in minted coins.

His appeal was denied in 2014, and prosecutors demanded that he face up to 23

years in federal prison, but he was only sentenced, in 2014, to 6 months’ house

arrest with 3 years’ probation.

Is

it any surprise then, that Satoshi Nakamoto, in 2008, decided to use a

pseudonym to release his project, and that, in 2011, the same year that Von NotHaus

was convicted, he decided to disappear from the scene? If the Federal

Government could bring charges against someone for creating independent silver

and gold coins, it is not beyond the realm of reason to suggest that similar

charges could be brought against Satoshi Nakamoto—if he were a U.S. citizen—for

creating something which resembles a currency, which is used in commerce, and

which also serves as an asset and commodity. Like gold and silver, Bitcoin is

hard money – and it was being used by payment providers across the globe, as

well as censured organizations, such as WikiLeaks. As such, Bitcoin not only

represents a competitor to the U.S. dollar, but it also represents a

censorship-resistant tool which can be used to evade sanctions, currency

controls and other government-sanctioned restrictions or capital controls.

Satoshi Nakamoto may have felt increasingly under the spotlight, and

increasingly threatened, and, as a result, decided to abandon the public

sphere, leaving Bitcoin without any centralized leadership figure. Since then,

Bitcoin’s claim to decentralization has been reinforced, unlike Ethereum, Ripple,

Cardano, NEO, TRON and Bitcoin Cash, all of which have personalities which lead

the show. [For more on Ethereum, see my article(s) entitled:

‘What

is Ethereum?’]

Other Reasons Satoshi May Have Left

Other suggestions for the reason behind his disappearance include

the possibility that Satoshi Nakamoto has died. This is usually tied to the

idea that Satoshi Nakamoto and Hal Finney are one and the same person. For that

to be true, of course, Finney would have had to have created fake correspondence

between himself and Satoshi, as there are e-mails to and from these two

individuals. He had always denied being the creator of Bitcoin, and he retired

from his company, P.G.P. Corporation in 2011.

In his last few years, he was only able to move his facial muscles,

communicating and writing Bitcoin-related software using a computer that

tracked eye movement. He suffered from amyotrophic lateral sclerosis (ALS) – a progressive

disease that results in problems swallowing, speaking, and breathing,

having

been diagnosed in 2009.

Finally, he died in 2014 at the age of 58, with his body being preserved by the

Alcor Life Extension Foundation in Scottsdale, Arizona, in the hope that he

could be revivified at some point in the distant (or perhaps near) future.

The

progression of his disease, culminating in 2011 with his retirement, as well as

his death in 2014, do seem to coincide with Satoshi’s inactivity from 2011 and complete

disappearance by 2014, but this is by no means proof of any connection. Another

suggestion, by early BitcoinTalk administrator Theymos, was that Satoshi was a

minor Cypherpunk hobbyist who came up with the idea for Bitcoin and may not

have been an actual “mathematician, cryptographer, or master software engineer”,

having perhaps “read a good C++ book” and then “put real effort into following

best practices”.

He then suggests that “he was having to deal more and more with people, which

he didn’t much enjoy”, with some starting “to question his technical decisions”

while, at the same time, “Satoshi probably felt like he was losing track of the

project, and moreover he didn’t see anything technology-wise that he

particularly wanted to work on.”

In other words, he gradually felt like he had lost control of his project and

abandoned it when it no longer interested him. Both of these suggestions seem

quite unlikely, though not impossible.

A Community Without Leaders

Much more likely, in my opinion, is the suggestion that Satoshi

Nakamoto felt that increasing public spotlight was endangering his anonymity,

leading to the possibility that his real identity might be discovered. In

addition to causing potential legal problems, as in the case of Von NotHaus,

Satoshi may have also felt that Bitcoin did not ultimately need leadership.

Leadership can have negative effects on a decentralised project such as Bitcoin,

as it brings undue attention to the personality behind the leader/creator. This

has been the case with not only Ethereum, which was founded by Vitalik Buterin,

but also other projects, such as Justin Sun’s TRON and Charles Hoskinson’s Cardano.

In the case of Ethereum, a hoax on the 4chan internet forum in 2017 stated that

Vitalik Buterin had died in a car crash, causing the price of ether (ETH)—the

native cryptocurrency of Ethereum—to dip below $300.

In

2016, Australian computer scientist, Craig Steven Wright (b. 1970), claimed to

be Satoshi Nakamoto, even apparently signing and verifying a message using

private keys from block #1 and #9. Security expert Dan Kaminsky, however, said that

this was a scam, and Bitcoin developer Jeff Garzik, provided evidence that

Wright’s claims were baseless.

Wright later went on to support Roger Ver (owner of Bitcoin.com) and Jihan Wu

(owner of Bitmain)’s fork of the Bitcoin blockchain called Bitcoin Cash (BCH),

which they claim represents the “original vision” of Satoshi Nakamoto. More recently,

when disagreements arose between the three over scaling solutions, Wright created

his own hard fork called Bitcoin Cash Satoshi’s Vision (BCH SV; BSV),

while Ver and Jihan Wu’s version became known as Bitcoin ABC (BCHABC).

Meanwhile,

Bitcoin (BTC) remains unscathed, free from these personality clashes and disagreements—decentralised

and leaderless.

|

| Cryptocurrency logos |

Another example: Charles Hoskinson, the CEO of Input Output

Hong Kong (IOHK), the company that is building Cardano, recently got into a

minor dispute with the Cardano Foundation, the non-profit organization that was

set up to drive adoption for Cardano and its cryptocurrency, ADA.

Under

its remit of overseeing the development of Cardano, the Cardano Foundation

hired a firm to audit Cardano’s codebase, costing an estimated $600,000 per

year. On September 14, 2018, the Cardano Foundation accused IOHK of not

responding to their first audit, while Hoskinson responded, saying that the

database in question was just a proof-of-concept, and that it had created two codebases

using IOHK’s own method, which should have been audited instead.

Such

a conflict, pitting the founder against the foundation responsible for the community,

does not exist in Bitcoin. Likewise, in the case of Justin Sun, there were

accusations (in a Reddit post) that he had sold billions of TRON (TRX) tokens (some

6 billion TRX, in fact), which was followed by a notable dip in the price.

Justin Sun denied the allegations, but the damage had been done. This is a classic

example of spreading Fear, Uncertainty and Doubt (FUD), which can be seriously

damaging to a cryptocurrency community. All of this is quite instructive as to

why Bitcoin does not currently need a leader, and the identity of Satoshi

Nakamoto is best kept a mystery—at least for now.

As Sun Tzu writes in The Art of War:

“Amid the turmoil and tumult

of battle, there may be seeming disorder and yet no real disorder at all; amid

confusion and chaos, your array may be without head or tail, yet it will be proof

against defeat.”

NJ Bridgewater

Information

Age (Wikipedia article). URL: URL: https://en.wikipedia.org/wiki/Information_Age

(accessed 02/12/2018 07:49 AST)

VisiCalc spreadsheet on an Apple II

VisiCalc spreadsheet on an Apple II

/2014%2F03%2F07%2Fac%2FAP407286670.05998.jpg)