-->

NJ Bridgewater

25 November 2018

Introduction

What is money? And where did

it come from? This is a subject which few people ask, because they know what

money is—or do they? The conventional wisdom is that money is something

printed by governments and distributed by banks. If I want money, I usually have

to go out and get a job. I work from 9am to 5pm or from 8am to 4pm, and then I

collect a pay cheque at the end of the week, or the end of the month. If I work

for cash-in-hand (and potentially avoid taxes while doing so), I might get paid

a lump sum at the end of the day. In either case, I am collecting either

printed notes, coins or digital money in my bank account. Money is, the

conventional wisdom states, divided into many different currencies, such as the

United States dollar (USD), the Great British Pound Sterling (GBP), the Euro

(EUR), the Swiss Franc (CHF), the Chinese Renminbi (or yuan) (CNY), the

Japanese Yen (JPY or JP¥), the Australian dollar (AUD), the Canadian dollar

(CAD), the New Zealand dollar (NZD), the South African rand (ZAR), the Kenyan shilling

(KES), etc. If we extend this further back into history, we would include the

Spanish doubloon (doblón), the British guinea, the Florentine florin,

the ancient Greek drachma, the Roman denarius, the Persian daric, the medieval

Islamic gold dinar, and the Lydian stater. All of these are government-issued

currencies, which consist of either paper notes or metal coins, being made

usually of gold, silver, copper or bronze. Money is backed by the government,

most people presume, so it is safe. Government money cannot disappear in a

day—it is something with the force of law behind it, and it is protected by a

legal system. Most currencies throughout history, moreover, have been backed by

precious metals, such as silver and gold, so this gives further solidity and

value to the currencies. And it’s always been like this, most people would

imagine. Is it necessary, therefore, for me to go on?

|

The Treasure of Villena (c. 1000 BCE)

|

|

Gold stater of Alexander the Great, Memphis mint (c. 336 – 323 BCE)

|

Money vs. Currency

The reality is far different

from the conventional understanding. The facts do not conform with what most

people imagine. Conventional currencies, as they exist right now, are not

sound money, nor are they backed by gold or other assets. Moreover, money, throughout

history, has not had value because of government decree. Money has value to

society because of its intrinsic value and the natural properties which characterise

it. In fact, when governments try to decree value for currency, this usually

results in negative effects. Governments cannot, in reality, control the value

of money, nor can they create money out of thin air. All they can do is to issue

currencies which are backed by assets, or made from precious metals, or they

can create debt in the form of fiat currencies, which are subject to massive

amounts of inflation, and are backed by nothing other than sentiment and

belief. All the major currencies which currently exist are actually fiat

currencies, meaning that they are created by decree (i.e. fiat). They are not

backed by anything at all. When the government creates a currency, all that

they are doing is creating 1s and 0s in a digital ledger, which are then loaned

out to banks, which loan these digital 1s and 0s to individuals. It’s

debt-backed 1s and 0s, electronic currency stored in computer databases. A lot

of paper notes are also printed, and coins, but these are only a small fraction

of the total money supply, which is almost entirely digital. I have explained

this in more detail in my article entitled ‘What

is Bitcoin?’ on my Crossing

the Bridge blog.[3]

Fiat currencies, such as the United States dollar, are literally created from

nothing and have no intrinsic value, other than the value that people believe them

to have. This is a uniquely modern phenomenon, as currencies in previous

centuries were backed by gold or silver.

.jpg) |

| $100 USD banknotes |

|

| One-third stater coin from Lydia (640 BCE) |

|

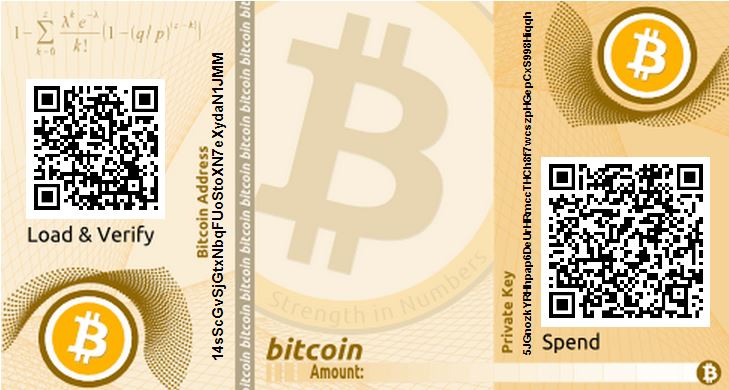

| Bitcoin paper wallet |

Let us then distinguish between “money” and “currency”. What the vast majority of governments use right now is not money. It is fiat currency, which is based on debt. It has not any real substance, other than what people believe it to have, and most of it is electronic. It can easily be hacked, manipulated, inflated and lost. It can also be subject to hyperinflation, which reduces the value of each unit due to failures in the economic and financial policy of a given country. “Money”, in contrast, is both a unit or medium of exchange and a store of value. The term “sound money” may be defined as hard currency, safe-haven currency or strong currency, which serves as a reliable and stable store of value, as opposed to soft currencies, which fluctuate wildly in value.[8] Fiat currency is a medium of exchange, but it is not a reliable store of value. It is money only in the sense that it is used to buy and purchase goods, but its value is highly inflationary and subject to manipulation. Money, in the truest sense, is capable of storing value over long periods of time, something which fiat currencies are currently incapable of doing. If you have $100 in your bank account today, it will be worth only a fraction of that in 10 years’ time. Therefore, fiat currencies do not meet all the requirements of being sound money, and must be regarded as soft currencies. In order to maintain value, money should be backed by hard assets, such as precious metals. If I know that $100 is backed by a certain amount of gold, then it would qualify as sound money, since that gold is limited in supply. So, let us try to go back to the history of money.

Proto-Money

Now that we understand that

money serves both as a medium of exchange and a store of value, we begin to

realise that the history of money goes back very far indeed. It has nothing to

do with governments, states, or central banks. Rather, money is something that

goes back to the very origins of human history and human evolution. This is

something which I have expounded upon at length in a previous essay, entitled “The

Origins of Wealth”, published in four parts on my Crossing the Bridge

blog.[9] It has also been addressed at length by Nick

Szabo in his article, “Shelling

Out: The Origins of Money”.[10]

Money is deeply-rooted in the human consciousness and psyche. It is commonly

believed that primitive man had no form of money, and that society was largely

equal, or perhaps “socialist” in structure. This is certainly the argument of

most Marxists, and other ideologues who want to warp reality to fit their

worldview. The reality, however, is quite different. Money is part of what we

are as human beings. Man is, in his earliest origins, both a social creature

and an intelligent being. He is essentially curious, sociable, inventive and

innovative. In the world of nature, there are natural resources and there is

wealth. Wealth is an element built into the fabric of reality. It’s not an

invented concept. It exists in the mineral kingdom, in the animal kingdom, and

in the resources which human beings create out of nature and reality. Early man

was able to collect rocks, shells and other items and fashion these into tools,

jewellery and ritual items. He was able to hunt animals and collect animal

skins. He created artwork and other handicrafts, weapons and ornaments. All of

these originated in the natural world, and they were transformed into new

commodities and collectibles.

Each human being, being

different in capacities, strength, intelligence and creativity, was able to

create or acquire different amounts of wealth. A skilled hunter might collect

many animal skins, whereas a craftsman might create many tools and weapons, and

a skilled jeweller might create many beaded necklaces. Everyone had natural

skills and abilities which allowed them to acquire different amounts of wealth.

This wealth could then be transferred through trade, warfare or marriage alliances.

As such, some early humans were wealthier than others, some bands had greater

wealth, and some tribes were stronger and more able to acquire wealth forcibly

or through trade. Natural self-interest and self-preservation led to warfare

and conflict between bands and tribes, as well as networks of trade and

commerce. The earliest human societies were based on the acquisition and trade

of capital, and were hence capitalist, rather than primitive socialist,

societies. Capitalism is an essential part of human nature, because each human

individual is different in their capacities and abilities to acquire, collect

and manage wealth. Why does wealth inequality exist? Because of the Pareto

principle, which is a fact of nature. The Pareto principle (also

called the ‘80/20 rule’) declares that 80% of the wealth tends to go to 20% of

the population.[11] For

more on that, see Part

3 of my essay on “The

Origins of Wealth”.[12]

The point is, money and differences in wealth are based on natural differences

between people and go back to the earliest eras of prehistory.

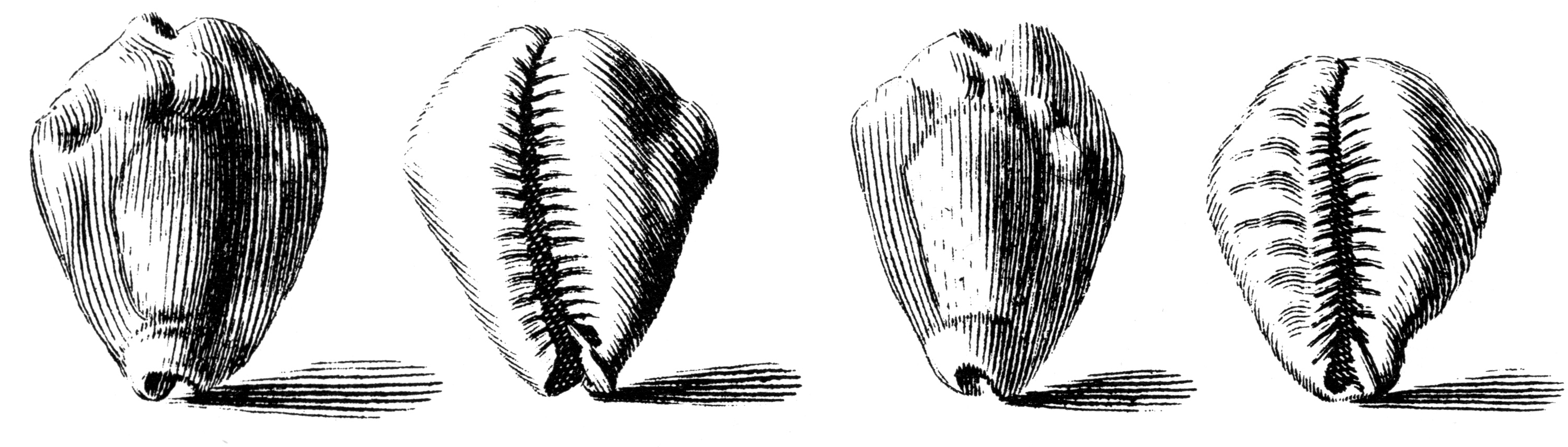

|

Money made from cowries (Cypraea moneta) (1742)

|

The earliest forms of money

took the form of collectibles. Shells were collected from coastal areas. These

were then traded with bands and tribes further inland. Those who lived farther

away from the sea had more difficulty acquiring shells. As such, shells were

limited in supply. These were denominated by collecting them into necklaces,

which could be easily transported. Shells collected by human beings can be

found as early as 67,000 – 63,000 years ago in the Panga ya Saidi cave on the

coast of Kenya, just north of Mombasa.[14]

About 33,000 years ago, beads from shells some 9 miles away became popular,

followed by beads made from ostrich shells some 25,000 years ago, and, roughly

10,000 years ago, seashells were commonly used.[15]

Shells served as primitive money, which could be used as a means of exchange

and a store of value. They could be traded for skins, tools, weapons, meat or

other resources. They could also be used as a bride price or dowry, allowing

for the exchange of that other important form of wealth: wives. Human capital,

indeed, has always been an essential component of wealth and wealth transfers.

Early Societies

For more on the earliest

forms of money, I would suggest reading the aforementioned article by Nick

Szabo, as well as my previous article on the Origins of Wealth.[16]

The point that we must take from the above is that money is a natural evolution

of human society. In the earliest human societies, proto-money existed in the

form of collectibles—objects which can retain value over time, serving as a

store of value as well as a means of exchange. In the case of shells or beads,

these can be stringed together and worn on the human body. The same goes for

animal skins, tools or weapons. Shells, however, were smaller and easier to

carry, and could also serve as jewellery. This meant that wealth could

literally be displayed on the human body as a visual display of capital. Shell

money could also be easily exchanged in the form of a bride price for a new

wife, allowing for the development of peaceful arrangements between tribes and

clans. Warring tribes and clans, likewise, could raid a rival clan and steal

their wealth, in the form of women, shells, skins and other collectibles.

Women, indeed, could also be seen as a form of transferrable wealth. Moreover,

as tribes grew in size and settlements became more permanent, it was also

possible to acquire slaves through war or trade, allowing for the greater

accumulation of human capital. Slavery, though certainly not good by modern

standards, was an important development in early human society, as it allowed

for greater diversification of human industry and labour.

|

| Lugal-kisal-si, king of Uruk |

It was in the Middle East

and Fertile Crescent that the first human settlements were made. This was, in

part, due to the climate and geography of the area, which allowed for the

domestication of a number of species, including sheep and goats, as well as a

number of different grains, allowing humans to increase their calorie

consumption and create permanent villages. This also allowed for the

development of the first organized societies with a priestly elite, who

developed organized religion, temples and collective worship, as well as

warriors, merchants, craftsmen and slaves, each fulfilling a particular role

within society. Greater wealth and food led to greater diversification of

skills. This also necessitated the creation of record-keeping, which took the

form of lines made with a reed pen on clay tablets. These started off as simple

drawings or representations of living objects, but quickly developed into a

full-fledged writing system, called cuneiform. This allowed the early priests

and scribes to record tributes and taxes from the surrounding countryside,

leading early settlements to transform from villages into the first cities, such

as Uruk (from which we get the word Iraq) and Eridu within Mesopotamia. I have

described this development in more detail in my previous essay on the Origins

of Wealth. These first cities developed a system of government and laws,

leading to the creation of law and order, which is an essential component of

capitalism. Capitalism consists of three main elements: a free market, the rule

of law, and private property. It is usually accompanied by some form of money

(or proto-money), though it could also work with a barter system. Whenever

these three elements are present, there is capitalism. Capitalism then, far

from being an ideology, is a condition that naturally arises as a result of

human development. Here’s a diagram I have made on the elements of capitalism.

The First Civilizations

What allowed mankind to

create the first civilizations? Human beings did not set out to build complex

societies. They were not created through some intentional feat of human social

planning. Rather, complex societies evolved over time, gradually and

incrementally, as the right conditions emerged, and the right systems developed.

Proto-money, as we learned above, consisted of shells, beads and other

collectibles. This allowed people to transfer and store wealth, i.e. capital.

The accumulation of capital was difficult in hunter-gatherer societies, as food

was limited and there was little diversification of labour. When humans began

to find grains and animals they could domesticate, however, they were able to

create fixed settlements and increase their food supplies. This allowed some

people to become farmers—others priests, others potters, others scribes, others

weapon-makers, and so on. This led to the creation of writing, permanent houses

of mud-brick, organized religion and laws to govern society. A diversified

labour force resulted in the creation of a market economy, in which each person

sold the goods and services he could create in exchange for other goods or

services, through a system of barter. Of course, shells and beads could still

be used to exchange these goods and services, but more efficient and more

permanent means of storing and exchanging capital were necessary. Humanity’s

wealth increased on a vast scale, and that wealth needed to be stored and

exchanged across vast distances. As the first cities emerged, warfare between

city-states became common and slavery emerged as captured enemies were forced

into labour. Trade also led to the creation of debt and debtors, leading some

people to lose their liberty in exchange for debts amassed: hence slavery.

The first money in ancient

Mesopotamia consisted of precious metals. According to Professor Hayat Erkanal, about

5,000 years ago, there was a trade of production surplus, leading to the use of

money for the first time.[19]

This early money consisted of rings made of gold, silver and other metals,

which were later turned into bullions of the same materials.[20]

Bullion means gold or silver (or other precious metals) measured and valued by

weight, rather than in the form of coins. This usually takes the form of bars

or ingots.[21] The

development of early money was tied to organized religion. Early temples were

not just places of worship—they served as the very heart, soul and centre of

every city. A city was, in reality, defined by its central temple, with

everything else surrounding this centre of worship. The construction and

maintenance of temples required a great deal of capital, which meant that

resources had to be collected and stored from the surrounding countryside,

allowing for the creation of building projects and the maintenance of a

priestly hierarchy. Cuneiform writing allowed the early Mesopotamians to record

taxes and make records of inventory. Production surpluses were collected within

temples, leading to a concentration of wealth and capital which could be used

to maintain the city. Eventually, these priests became priest-kings, commanding

armies and territory, which led to the creation of early kingdoms and empires.

How do we know that these early

societies had market economies? Amazingly, records of early trade still survive

in the form of hollow clay balls, called bulla. On the outside of a bulla,

parties to a contract could write down the details of the obligation, including

the resources to be paid, while, on the inside, there would be tokens which

represent the deal. These ancient records, indeed, were among the first

examples of financial contracts, and they date back to the city of Uruk in the

8th millennium BCE.[24]

Human beings have recorded numerical records for a long time, with the earliest

notation system going back 20,000 years, to the creation of the Ishango Bone,

which was found near one of the sources of the Nile in the Democratic Republic

of the Congo. It consisted of tally-marks on the thigh-bone of a baboon.[25]

The ancient Sumerians, however, developed a far more complex system for

recording numbers and figures. They developed abstract symbols to represent

different numbers, e.g. a circle for 10 and a stroke for 1. Thus, 23 could be represented

by a circle and three strokes.[26]

By this means, financial records could be recorded, including debts, interest

and other contractual obligations. The free market was maintained, furthermore,

by the creation of a system of laws, which were recorded in ancient law codes.

These law codes guaranteed the very first human rights, including the most

fundamental right of all—i.e. the right to private property. Ancient Sumerian

city-states, therefore, could be regarded as the first capitalist societies.

Mina, shekels and talents

The first recorded law-code,

the Code of Ur-Nammu (c. 2100 – 2050 BCE), defined the basic laws of property

and commerce which formed the basis of civilized, capitalist society. This

included rules for the maintenance of slaves, property, money, murder,

adultery, rape and sorcery.[27]

This included both capital punishment and punishments in the form of monetary

fines. For example, if someone knocked out the eye of another man, he would

have to pay one half a mina of silver. One mina was equivalent to 1/60th

of a talent and consisted of 60 shekels. One shekel was equivalent to 8.3 grams

or 0.3 ounces. At the present time, one ounce of silver is about $14.21 USD, or

$0.46 per gram.[28]

However, the price of silver is currently highly devalued due to the fact that

it is not currently being used as money. According to Dominic Frisby (2017),

the daily wage of a construction worker today is about £120, equivalent to

about 12 grams of silver in Athenian times, meaning that silver (by ancient

values), should be worth about £10 GBP ($14) per gram, or about $400 USD per

ounce.[29]

Half a mina is thus 30 shekels, or about 9 ounces of silver, i.e. about $3,600

USD by today’s standards, which is a pretty reasonable compensation. The

punishment for kidnapping is imprisonment and a fine of 15 shekels (about

$1,800 USD). Women also had fixed rights. If a man divorced his first-time

wife, he had to pay her one mina of silver (i.e. 60 shekels, or about $7,200

USD). If a man falsely accused another man’s wife of adultery, he had to pay

1/3 of a mina of silver (about $2,400 USD); if a man severed another’s nose

with a copper knife, he had to pay 2/3 of a mina (about $4,800 USD), and if he

knocked out another man’s tooth, 2 shekels (about $240 USD). If a witness

committed perjury, he had to pay 15 shekels of silver (about $1,800 USD).

Robbery and murder resulted in capital punishment.[30]

All of these punishments showed that there was not only a well-established

system of law and order, but also guaranteed property rights and an advanced

system of money, weights and measures, fines and financial compensation. These

are all established elements of a capitalist society.

|

| A silver Jerusalem shekel (68 AD) |

Ancient Wealth

There are many examples from

ancient history, scripture and legend that give us a picture of how much wealth

existed in the ancient world. The Prophet Job, for example, in the Bible, is recorded

to have owned some 7,000 sheep, 3,000 camels, 500 yoke of oxen, 500 she-asses,

and a great many servants.[32]

Likewise, the Prophet Abraham was said to have had an army of some 318 men,

presumably the able-bodied men among his servants/slaves.[33]

In the ancient world, the price of a sheep varied from 2.6g to 16g of silver,

e.g. about $36 to $224 USD. In Ancient Greece, the price of a slave was roughly

200 to 300 drachmas.[34]

One drachma weighed about 4.3 grams or 0.15 ounces of silver. Thus, 200

drachmas would be about 860 grams (i.e. about $12,040 USD). According to West

(1916), an ordinary labourer in the second century AD earned about 8 or 9 obols

per day (about $80 USD). With about 6 obols to the drachma, that makes about

5.73g of silver per day, or about 172g of silver per month.[35]

West estimates that camels sold between 144 – 160 AD sold for about 9 months’

wages, or about 1,548g of silver, i.e. about $21,672 USD. Job’s 3,000 camels,

therefore, would be worth about $65 million USD by today’s standards. His

sheep, likewise, would have been worth, at the very least, about $252,000 USD.

The Prophet Abraham’s able-bodied male servants alone would have been worth

about $3,828,720 million US dollars, assuming $12,040 per slave. And he

certainly had a much larger number of women, children and older men among his

flocks and herds, making him a considerably powerful and wealthy individual in

ancient Mesopotamia, Canaan and Egypt. What this shows us is not just that some

pastoralists and individuals were incredibly wealthy, but that they were able

to accumulate that wealth in a world where hard commodities and sound money

existed, where a free market allowed trade across vast distances, and a where

silver and gold were used to store value. In fact, Biblical accounts frequently

refer to both gold and silver, and the shekel is mentioned as a monetary unit

used by Abraham and others.

“And

all thy estimations shall be according to the shekel of the sanctuary: twenty

gerah[36]s

shall be the shekel.”[37]

-

Leviticus 27:25

Gold and Silver – Hard

Money

The question arises: why

gold and silver? This brings us also to the question of what sound or hard

money is. As we have already learned earlier, sound money is money which serves

as a store of value over time, as a means of exchange, and the value of which

is determined by the market. This latter element makes it very distinct from

fiat currency, which is denominated by government fiat, rather than the free

market. The best way to ensure that money can serve as a store of value is by

ensuring that it is scarce. Shells are cheap by the seaside, because there they

are abundant. Further inland, shells gain greater value, and when strung

together on a necklace, they have greater value still, due to the uniqueness

and rarity of the item. The value of shells, however, can go down over time as

the supply increases. Supply and demand determine the value of any good or

commodity, including money. If you flood the market with shells, you decrease

their value. When the purchasing power of a form of money is reduced, we call

this currency depreciation. The opposite is appreciation. When the supply

increases, we call this inflation. When the supply decreases, it is called

deflation. Inflation and depreciation go hand-in-hand, as money decreases in

value as the supply increases. Conversely, it increases in value as the supply

decreases. When governments print currency on a vast scale, as happened in

Germany, Zimbabwe and Venezuela at various times throughout history, the result

is hyperinflation, where fiat currency becomes practically worthless. The only

way to avoid such rapid fluctuations in the value of money is by ensuring that

it is limited and scarce. Gold and silver are excellent examples of money that

is scarce.

“Gold

and silver, like other commodities, have an intrinsic value, which is not

arbitrary, but is dependent on their scarcity, the quantity of labour bestowed

in procuring them, and the value of the capital employed in the mines which

produce them.”[38]

-

David Ricardo, The High Price of Bullion

Gold is great money because

of a few key properties: first and foremost, it is limited in supply. The exact

amount of gold in the world is unknown, but much of it has been used and reused

for thousands of years. The total amount of gold mined by 2017 is estimated to

be around 187,200 metric tonnes, with estimates varying by about 20%, with one

tonne of gold being valued (in 2017) at about $40.2 million, and the total

supply of gold in the world currently valued at about $7.5 trillion USD.[39]

According to the World Gold Council, two thirds of the current supply of gold

have been mined since 1950, meaning that, in ancient times, there would have

been no more than about 62,400 metric tonnes of gold. If all the gold in the

world were collected together in one box, it would only measure about 21 metres

on each side.[40]

That’s how little gold there is in the world. The second reason it makes good

money is because it is durable. Gold is practically indestructible. It does not

decay or rust over time. Therefore, the same gold that was in an ancient Roman

coin might be the same gold you have in your wedding ring today. This, along

with its scarcity, makes gold an excellent store of value. Third, gold is

incredibly recognisable and verifiable. The properties of gold are universally

recognisable, meaning that it is possible to easily verify that a gold coin or

bar is legitimate, thus avoiding counterfeit money, fraud and deception. This

means that gold it serves as a good means of exchange, because it is easy for merchants

and salesmen to exchange gold for goods and services without having to trust

the seller or buyer’s integrity. Trustlessness is essential for a

well-functioning free market economy.

The Ancient Money Supply

Other properties of gold,

such as its beauty, make it desirable as a commodity, but do not relate to its

usage as a form of money. Likewise, those who argue that gold is valuable

because of its use in science or jewellery, fail to understand the distinction

between gold as money and gold as a material. The same could be said of silver.

Silver, like gold, is a precious metal, meaning that it is highly sought after

and valuable, though that value has gone down in the present century due to its

demonetisation. It is estimated that there are currently 3 to 3.5 billion

ounces of .999 fine silver in the world.[42]

This is significantly more than was available in ancient times. By the second

century AD, R.P. Duncan-Jones estimated that the total money supply of the

Roman Empire was roughly 20 billion sesterces.[43]

One sesterce (sestertius) was equivalent to 1 quarter of a denarius—as

silver coin weighing 3.41g.[44]

The total supply in precious metals amounted to 880 tonnes of gold and 5,766

tonnes of silver. There was thus roughly 6 and a half times more silver than

gold in the Roman Empire, meaning that gold should have been about 6 and a half

times more valuable than silver at that time. If we value one sesterce at about

$10 USD (1 denarius = $40 USD), the total money supply would have been about

$200 billion USD. Both gold and silver are not chemically very reactive,

meaning that they can last for centuries. Thus, a large portion of the gold

that is circulating the world has been doing so for centuries, or thousands of

years, taking many different shapes and forms, as coins, jewellery and

artefacts are melted down and recast or coined. Gold coins from the time of

Alexander the Great still shine resplendent, while the mask of Tutankhamun,

which weighs some 22.5 lb (10.23 kg) of 18.4 karat and 22.5 karat gold,[45]

is immortal in its exquisite craftsmanship and resplendent glimmer. Gold

lasts—which is one of the key characteristics of sound money.

|

| The Mask of Tutankhamun |

The First Coins

Measuring gold and silver in

varying weights is all well and good, except that you can’t always carry a set

of scales with you, wherever you go. Money should be portable, and that means

that it should be possible to exchange it at a moment’s notice with a merchant

or vendor. So, how could that be achieved? In ancient Lydia, they found a

solution: gold and silver coins. In fact, the Lydians originally used a natural

alloy of gold and silver called electrum. The first coins, therefore, contained

both precious metals. The innovation of the Lydians was to basically stamp metal

to show that it was a standard amount, ensuring that the coins were both

fungible and countable. Fungibility means that something can be exchanged with

something of the same value. I can exchange one gold coin for another. It is

also divisible, because I can exchange one gold sovereign for two half-sovereigns,

for example, or two silver half-dollars for one silver dollar. Gold, silver and

electrum were already fungible as they could be measured and exchanged for

equal amounts of the same substance and weight, e.g. the shekel weight, but

they were not standardised. Coinage meant that money was now standardised and

weighing precious metals became unnecessary. The origin of this innovation is

disputed. Coinage may have been invented by King Croesus of Lydia (595 – 546

BCE), or Pheidon II of Argos (7th century BCE), while, according to

Aristotle, the first issuer of coins was Hermodike II of Kyme (probably the

first Greek to issue coins).[47]

The earliest coins were not used directly in commerce. Rather, they were

stamped with the image of a symbolic animal, e.g. a lion. These earliest coins

may have been used as medals or badges issued by priests of the Temple of

Artemis at Ephesus—a building which was counted as one of the Seven Wonders of

the Ancient World. The first coin used in retail on a large-scale was probably

the hemiobol (0.36 grams of silver, i.e. about $5 USD), or half an obol (0.72

grams, about $10 USD), which was a small silver coin issued by the Ionian Greeks

in the 6th century BCE.[48]

._Heavy_series._Sardes_mint.jpg) |

| Gold Croeseid, minted by King Croesus (c. 561-546 BCE) |

One of the innovations of

King Croesus of Lydia was the introduction of a double gold-silver standard,

with the introduction of pure gold and silver coins.[50]

So rich was Croesus that his name is used to represent extreme wealth with the

phrase ‘as rich as Croesus’. In fact, the Alcmaeonids, who were an illustrious

and ancient Athenian family, claimed to have obtained their wealth from

Croesus. Alcmaeon, their ancestor, was an assistant to the Lydians of Sardis

and he used to help them eagerly. When Croesus learned of Alcmaeon’s

enthusiasm, he summoned him and offered him to take as much gold as he could

carry. Alcmaeon, therefore, took a large tunic and high boots and filled both

his boots and every fold in his tunic with as much gold-dust as he could carry,

even sprinkling gold-dust in his hair and more in his mouth, so that he was

stuffed full of gold. Croesus, when he saw him, was amused, so he gave him

another portion of gold equalling that which he had taken.[51]

However rich Croesus may have been, however, his wealth did not last. He

probably died around 546 BCE, which is when Cyrus the Great of Persia marched

on Lydia, killed its king and took his possessions, confiscating all of his

wealth.[52]

Following this conquest, Cyrus the Great (550 – 530 BCE) introduced coinage to

the Persian Empire, which became the largest and greatest empire of the ancient

world. Like Croesus, the Persians practised bimetallism, with a duel

gold-silver standard, using the Persian daric (a gold coin) and the siglos

(a silver coin), which were both used throughout the Achaemenid era.[53]

Persian currency was updated

by Darius I (521 – 486 BCE), who introduced a new, thick gold daric with a

standard weight of 8.4 grams of gold (and with a purity of 95.83%), which equalled

20 silver sigloi (or 25 Attic Drachmae) in value, or about $1,500

USD. Like modern coins, the daric displayed an image of the Persian king (as a

warrior with bow and arrow). One siglos was equivalent to 7.5 Attic obols (1

obol = 0.72 grams; 7.5 = 5.4 grams of silver), or about $75 USD.[54]

After capturing Babylon following the Battle of Gaugamela, Alexander the Great

issued the double daric of 16.65 grams, which bore the name Alexander.[55]

Metal coins were also used from the beginning of Chinese imperial history. The

issuance of coinage was traditionally associated with Qin Shu Huang Di, the

first emperor, who united China in 221 BCE.[56]

This currency was called the Ban Liang, which means ‘half a liang’ (1 liang

being a Chinese ounce, or about 16 grams, and consisting of 24 zhu), thus

weighing about 8 grams (12 zhu). History tells us, however, that the

first Ban Liang coins were actually issued by the State of Qin during the

Warring States period. The State of Qin (Ch’in; Old Chinese: *dzin)

was an ancient Chinese state that existed during the Zhou dynasty, emerging as

one of the dominant powers of the Seven Warring States.[57]

Unlike their counterparts in the Persian Empire, however, the Ban Liang coins

were usually made of bronze, not silver. During the Han dynasty (from 118 BCE),

however, a new gold coin was introduced, which was equivalent to 10,000 bronze

Wu Zhu (‘five grain’) coins. One ‘grain’ was equivalent to 100 grains of

millet.[58]

In Western Han, 1 Jin was equivalent to 250 grams, so a 1-Jin gold weight was

equivalent to 250 grams of gold. At the time, 1 head of cattle would cost about

1.619 liang of gold, with a sheep at 0.952 liang.[59]

|

| Achaemenid Daric (c. 420 BCE) |

The gold and silver standard

across the world allowed for trade and commerce across vast differences. A

Persian daric or silver siglos could be used across the entire Persian

(Achaemenid) Empire, which encompassed a total area of between 3.6 and 5.5

million square kilometres,[61]

linked by a 2,500 kilometre highway, including the Royal Road, which stretched

from Susa (in the south-west of Persia proper, now in Khuzestan) to Sardis in

Anatolia (now located in Manisa Province, Turkey).[62]

By about 50 BCE, the Han dynasty likewise ruled over an area of some 6 million

square kilometres, throughout which their own gold-standard currency could be

used.[63]

Beyond this, of course, gold is easily convertible (i.e. fungible), so a

Persian daric, or a Chinese Jin, or Greek and Roman currency, could easily be

exchanged for goods and services. Merchants and businessmen, traders and

farmers, across the whole stretch of the Old World, were well aware of gold and

silver’s value, as it was sound money. No one would refuse a coin simply

because it bore the face of Darius, regardless of his national origin. Gold is

gold, silver is silver, and real money is real money. Try buying bread with a

Confederate paper dollar or a nineteenth-century British copper or bronze penny

and see if you can convince the buyer to part with his goods. In all

likelihood, he will not. Offer to trade an ancient Persian daric for some food

in 2018, and you will probably find a buyer. It might not be accepted at your

local chain supermarket, but you’ll find someone willing to part with his goods

for sound money, because we instinctively know what is good and what isn’t good

money.

Gold, Silver and

Prosperity

Not only is gold and silver

good money, because of all the reasons mentioned above, i.e. they are scarce, durable,

verifiable and fungible, as well as trustless—they are also a source of growing

wealth and prosperity, because they allow people to store value over time and

use it to build up trade and industry. Sound money, moreover, has a value

determined by the market, rather than by fiat, and this is what we mean by

‘good money’. The various government decrees to strike coins or measure them by

weight and purity, are merely the means by which the precious metals are

weighed, but the value is in the precious metals themselves, with their value

being determined by the law of supply and demand. Why would such money lead to

prosperity? The answer lies in the various incentives which using sound money

creates. Imagine if we lived in a city-state. In this city state, the

government constantly needed to create new currency to pay for wars or public

building projects. They also needed to support the cost of the arena and

theatre, where the citizens would go for entertainment, and for free bread for

the freemen of the city. This constant need to expend money means that the

city-state must issue new currency to cover its debts. As a result, the state

issues more and more debased currency.

The city-state starts off

with coins that are made of gold. Then they mix the coins with bronze, until

eventually they issue thousands of bronze coins covered with gold. Finally,

they have to issue tens of thousands of bronze coins backed by nothing other

than the decree of the state. Every time the coins are debased, the money

supply increases, leading to inflation, while the value of each coin decreases.

In such a case, would you want to save your money or spend it? The price of

milk last month was 1 bronze coin. Now, a gallon of milk costs 10 bronze coins.

Instead of keeping your bronze coins, you will no doubt spend them on an

ever-increasing number of things. Perhaps you’ll buy an extra toga—a blue

one—and maybe a few new vases, and a leather ball for your son, and a wooden

mug, and so on. You’ll keep spending the currency because it is like a hot

potato. If you keep it in your hands too long, it will burn up and be worth

nothing at all. Therefore, you have to keep throwing it around, until it loses

it all its value. If you’re the last person to receive the hot potato in that

game, you lose. This creates a society of spenders, who spend money on

an increasing number of frivolous or less-than-useful things, while the

government spends money on an increasing number of wars and crippling debts.

Eventually, the debts exceed the government’s capacity to create new money, and

the entire society collapses. Your city-state gets taken over by a rival tribe

or city, your civilization collapses, you go from wealthy merchant to peasant,

or you might be killed, captured as a slave, or made to fight in gladiatorial

combat for the amusement of a wealthy Roman. Game over!

This scenario has been

repeated again and again, and still applies today, as we will find out below in

relation to inflation and currency debasement in Rome. With sound money,

however, the opposite is true. When a country has a gold-standard, the opposite

incentive is created. People are encouraged to save their money. When they save

money, they are able to build up capital. This allows them to create

businesses, which in turn leads to economic growth and innovation. The farmer

one year may become the merchant the next; the merchant may become a member of

the gentry or a nobleman, and the nobleman may become a king. Even slaves in

many societies could save up money over time and buy their freedom. A debtor

could save up money and pay off his debts. Likewise, people’s tastes in art,

architecture and music tended to appreciate low time-preference works,

such as a sculpture which takes months to produce, a painting that takes days, or

a building which takes years to build. This is because people can afford to wait

to spend their money. There is no hot potato effect, so people can save their

money, bide their time, and purchase works of art or architecture which take a

great deal of time, effort and imagination to produce. There is no wasteful

consumer economy. Society values good taste, excellent craftsmanship and

invention. Rather than pursuing frivolities, people pursue useful commerce and

industry which will allow them to accumulate more sound money. Governments,

likewise, refrain from excessive debts and military spending, as they cannot

afford to use up all their stores of precious metals. Sound money leads to a

sound economy, economic growth and prosperity.

The Roman Empire

Human greed and the desire

for power often result in corruption and the downfall of civilizations.

Governments desire, first and foremost, to maintain power and control. Kings

and emperors, throughout history, have desired to expand their territories, and

the leaders of Greek democracies and the Roman Empire were no different. War is

expensive, however, and requires a great deal of funds, and there is only so

much money within the coffers of any state at one time. What was there to do,

therefore, but to increase the money supply and allow the state to pursue

warfare through currency debasement? While ancient Lydia had pure, sound money,

and the Athenian drachma was maintained at 67 and 65 grains of silver over

time,[66]

other Greek city-states mixed their coins with base metals and debased the

currency, leading to inflation. Eventually, even the Athenians resorted to

bronze coinage during times of war, issuing token bronze coins in 406 BCE to

help defray the costs of the Peloponnesian War (431 – 404 BCE).[67]

Athens lost that war, by the way, so currency debasement did them no good. Debasement

was also carried out by Dionysius of Syracuse, who called in all coins for

counter-stamping, reducing the standard by half while doubling their nominal

value and keeping half the coins to pay off his outstanding debts, thus

debasing the currency by 50%.[68]

Rome, the great empire of Europe, originally had a stable currency based on

gold and silver. This, along with the other elements of capitalism, including

the rule of law and a free market, allowed for the development of unparalleled

wealth and prosperity. Marcus Licinius Crassus, for example, was estimated by

Pliny to have had a total wealth of approximately 200 million sesterces,[69]

which is equivalent to about $8 billion USD in today’s currency.

|

| Bust of Marcus Licinius Crassus |

For centuries, the Roman

Empire was the pinnacle of human civilization. Stretching across Europe and

North Africa, from the Pillars of Hercules and the British Isles in the West, to

Egypt and Libya in the south, to the edge of Anatolia, Syria and Arabia in the

East, the Roman Empire was one of the largest and most powerful empires in

history, comprising a total area of about 4.4 million square kilometres by 390

AD, and with a population of about 56.8 million people by 25 BCE.[71]

According to Madison (2003), the GDP per capita across the Roman Empire was

about $570 USD (in 1990 PPP Dollars),[72]

though Lo Cascio and Malanima (2009) have revised this to $1400 G-K

(Geary-Khamis) dollars,[73]

which is roughly twice the Mesopotamian per capita income of roughly $728 1990

G-K dollars (about 30 shekels per year, or 2.5 shekels per month).[74]

At the same time, subsistence level income in Mesopotamia, i.e. enough money to

survive, would have been about $400 G-K dollars.[75]

Roman GDP was also quite similar to the per capita income of the average

Englishman between 1676 – 1700 AD, who earned roughly 9.958 pounds Sterling per

capita, or about $1411 1990 G-K dollars. Nevertheless, there were great

concentrations of wealth among the Roman ruling elites. At the time of the

first emperor, Augustus Caesar, a Senator had to be a citizen of free birth,

not be convicted of crimes under the lex Julia de vi privata, and have

property worth at least 1,000,000 sesterces, i.e. about $10 million USD, and

the total number of Senators was about 600 (600 x $10 million = $6 billion

USD).[76]

Disparities of wealth, therefore, are not a recent phenomenon, though the

standard of living has now vastly increased for everyone on the planet.

Inflation and Currency

Debasement – the Fall of Rome

The enemy of prosperity, of

course, is inflation. The city of Rome was founded, according to tradition, on

the 21st of April 753 BCE. The Roman Republic lasted from 509 – 27

BCE, a period of almost 500 years, and the Roman Empire lasted from the reign

of August Caesar (27 BCE – 14 CE) until the last Roman Emperor, Romulus

Augustulus was deposed by the Germanic King Odoacer on the 4th of

September 476 CE—a period of 502 years. In total, the Roman Republic and Empire

together lasted a period of about 1,000 years. Roman coinage was introduced in

the Roman Republic c. 300 BC, beginning with bronze and silver coins following

the example of the Greek city-states.[77]

This replaced the earlier system of aes signatum (Latin for ‘struck

bronze’), which consisted of large, bronze bullion (measuring 160 x 90 mm; 6.3

x 3.5 in), and weighing between 1,500 and 1,600 grams (53 – 56 oz).[78]

Julius Caesar was the first ruler of Rome to introduce coins bearing his

profile, which practice was followed by Augustus and later emperors.[79]

The silver denarius of August contained about 95% silver, which was reduced to

85% by the time of Emperor Trajan in 117 AD. The trend of currency debasement

sped up in the subsequent centuries, being reduced to 75% silver by the time of

Marcus Aurelius in 180 AD, 60% in the time of Septimius and 50% by the reign of

Caracalla, who was assassinated in 217 AD. It was in that same century that

Rome experienced one of its worst periods, the Crisis of the Third Century,

which lasted from AD 235 to 284, also known as the Military Anarchy or the

Imperial Crisis, during which the empire nearly collapsed.

It was during this time of

crisis that that the Emperor Diocletian (244 – 311 AD) introduced even more debased

and inflated currency. The situation of third century Rome was rather like the

modern world today, in the sense that the government resorted to the use of

fiat currency and the state suffered from a number of self-induced crises and

intractable problems. Diocletian’s economic policies, fraught with bad

consequences as they were, are also reminiscent of the prevailing policies and

economic theories of the 20th and 21st centuries. One of

these policies was the Edict of Maximum Prices, which was issued in 301 AD. The

edict not only set out to further inflate the official Roman currency, but it

also set a series of price controls (or ‘price ceilings’), on well over a

thousand products, including food items, clothing, freight charges and weekly

wages.[80]

By 268 AD, the Roman denarius had become so debased that it only contained 0.5%

silver. Diocletian, therefore, did away with this coin altogether, replacing it

with a new coin called the argenteus, which was fixed at a value of 50 denarii

(of the old debased standard), with 96 coins to the pound of silver. While this

might be seen as a positive step, Diocletian also introduced a new bronze coin

fixed at a value of ten denarii, called the nummus. Despite these

efforts, however, no more than a decade passed before the value of the nummus

had inflated to 20 denarii and the argenteus from 50 denarii to 100, resulting

in an inflation rate of 100%. The Emperor Constantine, who reigned during the

fourth century, issued a new gold coin called the solidus, which was struck at

72 coins to the pound, being even more debased than Diocletian’s.[81]

|

| Nummi coins from the reign of Anastasius I |

In addition to currency

debasement and price controls, the later Roman emperors also sought to manage

the economy with ever-increasing taxation, much like modern Western democracies

today. In the early Roman Empire (30 BCE – 235 CE), the Roman government paid

for what it needed with gold and silver. By the time of the Crisis of the Third

Century, however, this was no longer possible, so the government resorted to

“requisition”, which basically means ‘forced purchase’, to support its armies

and other expenses.[83]

This was combined with a number of land taxes. Increased taxation leads to

decreased productivity, resulting in worse economic performance. It’s a vicious

cycle. As government taxes go up, people have less incentives to be productive,

resulting in abandonment of businesses, farms, etc. As Thomas Sowell explains,

existing tax systems, like those of Diocletian, tax productivity rather than

consumption. He writes that “someone who is adding to the total wealth of this

country is not depriving you of anything. But someone who is consuming the

nation's wealth, without contributing anything to it, is. Yet our tax system

penalizes those who are producing wealth in order to subsidize those who are

only consuming it.”[84]

He also attributes Rome’s decline to the growth of “a large parasitic lass”

which served as “an underclass supported by government handouts”, along with “a

large and growing bureaucracy.”[85]

Like today, ancient Roman

had elections and politicians who benefited by appealing to the masses. Rome

had a system of poor relief, which initially began by introducing low-cost

wheat. This was eventually transformed into free wheat and, by the time Julius

Caesar took power, there were some 320,000 people receiving grain relief.[86]

Caesar set about to trim down the welfare state, reducing the number of people

receiving relief to 200,000, but, forty years later, it had risen again to

about 300,000.[87]

The welfare state, once established, is difficult to dismantle, as people

become dependent on it. Emperor Aurelian, who reigned from 214 – 275 AD,

further entrenched the institution by making wheat relief hereditary. In fact,

what is worse, the government no longer provided wheat which one could cook at

home, but, rather, provided government-baked bread, and added free salt, pork

and olive oil, thus increasing the ranks of the unproductive citizenry and

ramping up government spending, which, in turn, led to greater currency

debasement and inflation.[88]

The government, therefore, had to requisition and tax more property from the

productive citizenry, further destroying economic productivity. The same effect

can be seen today in the massive welfare states of Western governments, which

are burdened by huge and unpayable debts—debts which could potentially destroy

the entire economic world order within the next few decades. The result of

Diocletian’s policies in 301 are well-described by a contemporary called

Lactantius, who wrote, in 314 AD:

“After

the many oppressions which he put in practice had brought a general dearth upon

the empire, he then set himself to regulate the prices of all vendible things.

There was much bloodshed upon very slight and trifling accounts; and the people

brought provisions no more to markets, since they could not get a reasonable

price for them; and this increased the dearth so much that at last after many

had died by it, the law itself was laid aside.”[89]

By the 5th

century, the Roman Empire had decayed to such an extent that it was subject to

foreign invasions and the sacking of Rome. In 330, the Emperor Constantine had

moved the seat of the Roman Empire to Constantinople, which was founded as a

second Rome. The last Roman Emperor to rule both the Western and Eastern

portions of the Empire was Theodosius I (379 – 395 AD). Theodosius was a

Christian who issued a series of decrees banning pagan religions, festivals,

sacrifices and the Olympic Games. The last Olympic Games were held in 393 AD.

Splitting the empire in two, Theodosias bequeathed the Western Empire to his

son Honorius, and the Eastern Empire to Arcadius.[90]

The Eastern Empire, which managed to defend itself through mercenaries and

placating invaders with tribute, survived and became known to historians as the

Byzantine Empire. The Western Empire, based in Rome, however, was not so

fortunate. Even Theodosius himself was so weak that he had to pay an enormous

annual tribute to Attila the Hun, literally paying him not to invade Rome and

destroy the empire.[91]

Lack of national security and secure borders was a fatal problem. Germanic

tribes harassed the borders of the Empire to the north, and the economy and

social order collapsed within. This was due, in large part, to government

manipulation of the economy. Constantine the Great continued Diocletian’s

policies of economic regulation, going so far as to tie workers to the land,

along with their descendants, thus preventing internal migration of

agricultural workers and causing economic stagnation. Nevertheless, tenants

still abandoned land and trade decreased. The government continued to

requisition resources, including food from farmers, leading to farmland

becoming deserted wasteland.[92]

|

| The Emperor Diocletian |

In order to continue to pay

for defence spending, the Roman Empire had to increase taxes yet more. In 444

AD, the sales tax rose from 1% to 4.5%. Nevertheless, tax revenues fell as more

and more wealthier Romans sought to avoid excessive taxation. Large landowners

began to attract small communities of tenants around them, with some people

even signing on as slaves in order to support themselves. At the end, there was

no money left to support the army, and the barbarians flooded in, being

welcomed as saviours from excessive taxation and currency debasement.[94]

In 410 AD, the Romans abandoned Britain, for example, leading to the end of

Romano-British Britain. Britain was under attack from Germanic barbarians, and

Rome had failed to provide protection. This led to the Romano-Britons expelling

the magistrates of the usurper Constantine III. When the Western Roman Emperor

Honorius was asked to provide assistance to the island, as well as other Roman

cities, he replied with the Rescript of Honorius, telling the Roman cities to

look after their own defence. He was himself already tied up with defending

Italy from the Visigoths under Alaric, and the City of Rome itself was under

siege.[95]

Rome was sacked on the 24th of August 410 AD by Alaric. By 402 AD,

the capital of the Western Roman Empire had moved from Rome to Ravenna, in

northern Italy, until the ultimate collapse of the Empire in 476 AD, when Odoacer

advanced to Ravenna, capturing the city and forcing the 16-year-old emperor to

abdicate on the 4th of September. The Eastern Roman Empire

recognised Odoacer’s conquest, giving him the title of Patrician, while he

himself took up the role of King of Italy.[96] The Roman Empire had ended. Inflation,

excessive taxation and a large welfare state had finally brought down one of

the greatest civilizations of all time.

China and Paper Money

China, as we learned

earlier, used both precious metals and bronze coins. However, in the early 8th

or 9th centuries, China introduced its own innovation: paper

currency, called ‘flying money’.[97]

This began as a draft rather than bank-issued currency, but private merchant

drafts were replaced by government-issued notes in the early 9th

century, under the Song dynasty (960 – 1279 AD), allowing the forwarding of

taxes and revenues to the imperial capital (Chengdu, China). This first paper

currency was called Jiaozi. Paper currency was eventually replaced by more

durable silk-money, and, by the late 13th century, there was a

unified currency throughout China, being used as far afield as Persia, with

Marco Polo himself remarking on the innovation. Originally, this ‘paper money’

was backed by precious metals, just like the U.S. dollar and British pound

Sterling. Like these more modern currencies, however, they were soon detached

from the sound assets to which they had been tied. Under the Mongol-founded

Yuan dynasty (1271 – 1368 AD), a new, paper-based monetary system was created,

which was not backed by silver or gold, becoming the world’s first truly-fiat

currency.[98]

The ancient Greeks had inflated their currencies by using bronze coins in

addition to silver and gold coins, but at least bronze had some value in and of

itself, and it was sometimes used as bullion. The Yuan dynasty’s paper

currency, however, was backed by nothing but faith, and was known as Chao. Like

modern fiat currency, the Chao was printed (another Chinese innovation).[99]

In addition, like modern fiat currencies today, the Chao was subject to massive

inflation, as the government printed as much currency as it wanted to cover its

expenses, leading to an expansion of the “money supply”, reducing purchasing

power for each banknote. The problem grew to such an extent that the entire

currency had to be replaced in 1287 AD, but inflation remained a problem until

the end of the Yuan dynasty.[100]

|

The Ming Dynasty began with

promise, and the Great Ming Empire lasted for 276 years (from 1368 – 1644 AD),

only to be followed by the Qing Dynasty—the last Chinese ruling dynasty. The

Ming Dynasty was a native Han Chinese dynasty, replacing the Mongol-led Yuan

dynasty. Its founder, the peasant-born Hongwu Emperor (r. 1368 – 1398),

initiated a series of reforms from his capital of Nanjing, breaking the power

of the court eunuchs, leaving a ‘mirror for princes’ with admonitions for his

descendants to follow (i.e. the Huáng-Míng Zǔxùn, “Instructions of the

Ancestor of the August Ming”), and leaving a legacy which was further fortified

by his successors, including the Yongle Emperor, who established Beijing

(formerly Yan) as a secondary capital, constructing the Forbidden City,

restoring the Grand Canal and patronising the explorer Zheng He, who explored

as far afield as Arabia and Africa.[102]

When it came to money, however, the Ming Dynasty made the same mistake as the

Yuan. From the beginning of the Ming Dynasty (i.e. 1368) until 1450 AD, the

Ming used paper currency, resulting in the same hyperinflation suffered under

the Yuan. The Ming note was known as the ‘precious note of great rising’ and

was only introduced in one denomination, making divisibility impossible.[103]

Copper coins were allowed to circulate, however, and this allowed for payments

in smaller denominations. Due to the increasing worthlessness of the paper

currency, silver gradually replaced the ironically-named ‘precious notes’.[104]

Barter was widely used until silver began to flow in from Japan and Spain (via

the Manila Galleon), being traded as bullion called sycee or yuánbǎo

(lit. ‘coin pouch’). Sycee was not made by a central bank but, rather, by

individual silversmiths, and was formed in various shapes, including square and

oval ingots, boats, flowers, tortoises and other forms.[105]

Cowrie shells were also traded during this period. Spanish dollars were also

used. These, being approximately 38mm in diameter, where minted in the Spanish

Empire from 1598 AD and corresponded with the German thaler.[106]

So influential was this currency that it formed the basis of the United States

dollar and remained legal tender in the United States until the Coinage Act of

1857.[107]

By the 18th century, the Spanish dollar was virtually a world

currency.[108]

While the Chinese were the

first to introduce paper money, they were not the last. By the period of Late

Imperial China, under the Qing Dynasty, China had both a silver and copper

currency system, based on copper cash (called wen) and silver cash

(called lí). One lí, or ‘silver cash’, was equivalent to 0.0013

ounces (or 0.037g) of silver, with 1,000 silver cash being equivalent to 100

candareens, 10 mace or 1 tael (liang) of silver, i.e. 37.8g.[109]

This remained the system until 1889, when the Chinese yuan was introduced on a

par with the Mexicon peso, i.e. 8 Spanish reals.[110]

Even after the overthrow of the Qing Dynasty and establishment of the Republic

of China, a silver standard was maintained. While the United States left the

gold standard due to the Great Depression, China maintained its silver standard

until 1935, when China resorted back to a fiat currency system, issuing ‘legal

notes’. Along with Hong Kong, China was the last country to maintain a silver

standard.[111]

The People’s Republic of China, likewise, issued renminbi banknotes from

December 1948, continuing the fiat standard. That was, of course, until 2005,

when the value of the renminbi was pegged to the US dollar, effectively

creating a US-dollar standard.[112]

We will look at this new fiat standard in the section on the ‘Age of Fiat

Currency’ below. For now, let us divert our attention to the golden age of

money, which coincided with the great European Age of Exploration and

Discovery.

©️NJ Bridgewater 2018

[1] Image source: Treasure of Villena as

a whole, 10th century BCE (CC BY-SA 3.0), created by Unknown, circa

2000 AD. URL: https://upload.wikimedia.org/wikipedia/commons/7/7a/Tesoro_de_Villena.jpg

(accessed 22/11/2018). For more on the license, see:

https://creativecommons.org/licenses/by-sa/3.0/ (accessed 22/11/2018).

[2] Image source: Gold stater of

Alexander the Great (17mm, 8.59 g, 3h). Memphis mint, circa 336-323 BC. (CC

BY-SA 3.0). Classical Numismatic Group, Inc. http://www.cngcoins.com. URL:

https://upload.wikimedia.org/wikipedia/commons/6/6a/Gold_stater%2C_Alexander_the_Great%2C_323_BC%2C_Memphis.jpg

(accessed 22/11/2018). For more on the license, see:

https://creativecommons.org/licenses/by-sa/3.0/ (accessed 22/11/2018).

[3] See: NJ Bridgewater (2017) What is

Bitcoin? Crossing the Bridge, 7 December 2017. URL: https://nicholasjames19.blogspot.com/2017/12/what-is-bitcoin.html

(accessed 23/11/2018).

[4] Image source: 100 USD banknote (CC

BY-SA 2.0). URL:

https://upload.wikimedia.org/wikipedia/commons/b/b0/Money_100_USD_%284792018878%29.jpg

(accessed 22/11/2018). For more on the license, see:

https://creativecommons.org/licenses/by/2.0/ (accessed 22/11/2018).

[5] Image source A 640 BCE one-third

stater coin from Lydia, shown larger. Classical Numismatic Group, Inc.

http://www.cngcoins.com (CC BY-SA 3.0). URL:

https://upload.wikimedia.org/wikipedia/commons/a/ae/BMC_06.jpg (accessed

22/11/2018). For more on the license, see:

https://creativecommons.org/licenses/by-sa/3.0/ (accessed 22/11/2018).

[6] Image source A sample picture of a

fictional ATM card (CC BY-SA 3.0), created by Airodyssey at English Wikipedia

(own work). URL:

https://en.wikipedia.org/wiki/Money#/media/File:ClientCardSample.png (accessed

22/11/2018). For more on the license, see: https://creativecommons.org/licenses/by-sa/3.0/

(accessed 22/11/2018).

[7] Image source Bitcoin paper wallet,

http://bitaddress.org/ (MIT license), created 29 November 2013. URL: https://upload.wikimedia.org/wikipedia/commons/d/db/Bitcoin_paper_wallet_generated_at_bitaddress.jpg

(accessed 22/11/2018). For more on the license, see:

https://opensource.org/licenses/mit-license.php (accessed 22/11/2018).

[8] See: Hard currency (Wikipedia

article). URL: https://en.wikipedia.org/wiki/Hard_currency (accessed 02/11/2018

12:02 PM).

[9] See: NJ Bridgewater (2018) The

Origins of Wealth (Part 1 of 4), Crossing the Bridge, Thursday, 5, July

2018. URL:

https://nicholasjames19.blogspot.com/2018/07/the-origins-of-wealth-part-1-of-4.html

(accessed 02/11/2018).

[10] See: See: Nick Szabo (2002) Shelling

Out: The Origins of Money, Satoshi Nakamoto Institute. URL:

https://nakamotoinstitute.org/shelling-out/ (accessed 02/11/2018).

[11] See: Pareto principle (Wikipedia article).

URL: https://en.wikipedia.org/wiki/Pareto_principle (accessed 23/11/2018 12:41

AST).

[12] See: NJ Bridgewater (2018) The

Origins of Wealth, Part 3, Crossing the Bridge, Friday, 6 July 2018.

URL: https://nicholasjames19.blogspot.com/2018/07/the-origins-of-wealth-part-3-of-4.html

(accessed 23/11/2018).

[13] Image source: 1742 drawing of shells

of the money cowry, Cypraea moneta. Public domain. URL: https://en.wikipedia.org/wiki/Cowry#/media/File:Cypraea-moneta-001.jpg

(accessed 22/11/2018).

[14] See: Jason Daley (2018) People Lived

in This Cave for 78,000 Years, Smithsonian.com, May 11, 2018. URL:

https://www.smithsonianmag.com/smart-news/people-lived-cave-78000-years-180969051/

(accessed 22/11/2018).

[15] See: Daley (2018).

[16] See: NJ Bridgewater (2018) The

Origins of Wealth (Part 1 of 4), Crossing the Bridge, Thursday,

05/07/2018. URL:

https://nicholasjames19.blogspot.com/2018/07/the-origins-of-wealth-part-1-of-4.html

(accessed 22/11/2018).

[17] Image source: Lugal-kisal-si, king

of Uruk. Public domain. URL:

https://upload.wikimedia.org/wikipedia/commons/a/ac/Male_bust_Louvre_AO10921.jpg

(accessed 22/11/2018).

[18] Image: NJB (2018) The Elements of

Capitalism.

[19] See: ADANA (Anadolu Agency) (2014)

Money used by Sumerians in Mesopotamia, says expert, Hurriyet Daily News,

January 13, 2014 00:01:00. URL:

http://www.hurriyetdailynews.com/money-used-by-sumerians-in-mesopotamia-says-expert-60909

(accessed 12/11/2018).

[20] See: ADANA (2014).

[21] See: Bullion (Wikipedia

article). URL: https://en.wikipedia.org/wiki/Bullion (accessed 12/11/2018 07:45

AST).

[22] Image source: Sumerian inscription

in monumental archaic style, c. 26th century BC. Public domain. URL:

https://upload.wikimedia.org/wikipedia/commons/9/91/Sumerian_26th_c_Adab.jpg

(accessed 22/11/2018).

[23] Image source: A bulla (or clay

envelope) and its contents on display at the Louvre. Uruk period (4000 BC–3100

BC). Public domain. URL: https://upload.wikimedia.org/wikipedia/commons/0/0a/Accountancy_clay_envelope_Louvre_Sb1932.jpg

(accessed 23/11/2018).

[24] See: Tim Harford (2017) How the

world's first accountants counted on cuneiform, BBC News, 12 June 2017.

URL: https://www.bbc.co.uk/news/business-39870485 (accessed 12/11/2018).

[25] See: Harford (2017).

[26] See: Harford (2017).

[27] See: Code of Ur-Nammu (Wikipedia article).

URL: https://en.wikipedia.org/wiki/Code_of_Ur-Nammu (accessed 12/11/2018 08:05

AST).

[28] See: Silver Prices Today, Live Spot

Prices & Historical Charts, Money Metals Exchange. URL:

https://www.moneymetals.com/precious-metals-charts/silver-price (accessed

12/11/2018 07:59 AST).

[29] See: Dominic Frisby (2017) What

wages in ancient Athens can tell us about the silver price today, MoneyWeek,

02/03/2017. URL: https://moneyweek.com/462534/what-wages-in-ancient-athens-can-tell-us-about-the-silver-price-today/

(accessed 12/11/2018).

[30] See: Code of Ur-Nammu (Wikipedia article).

[31] Image source: A silver Jerusalem

shekel (ad 68) from the First Jewish Revolt against Roman rule. The obverse

inscription reads "Shekel of Israel / Year 3" and that on the reverse

"Jerusalem the Holy". Classical Numismatic Group, Inc.

http://www.cngcoins.com (CC BY-SA 3.0). URL: https://upload.wikimedia.org/wikipedia/commons/2/27/CairoEgMuseumTaaMaskMostlyPhotographed.jpg

(accessed 22/11/2018). For more on the license, see: https://creativecommons.org/licenses/by-sa/3.0/

(accessed 22/11/2018).

[32] Job 1:3 (King James Version).

[33] See: Genesis 14:14 (King James

Version).

[34] See: Spiros (2012) How much expensive

was life in ancient Greece, Hellenic History Subjects, Saturday, April

7, 2012. URL:

https://akrokorinthos.blogspot.com/2012/04/how-much-expensive-was-life-in-ancient.html

(accessed 11/12/2018).

[35] See: Louis C. West (1916) The Cost

of Living in Roman Egypt, Classical Philology, Vol. 11, No. 3 (Jul.,

1916), pp. 293-314 (22 pages). URL: https://www.jstor.org/stable/261854

(accessed 11/12/2018).

[36] One shekel weighed 180 grains (11

grams or .35 troy ounces). One gerah is equivalent to 9 grains or 0.57 grams.

[37] Leviticus 27:25 (King James Bible).

[38] See: Ricardo (1810), p. 2.

[39] See: Gold reserve (Wikipedia

article). URL: https://en.wikipedia.org/wiki/Gold_reserve (accessed 12/11/2018

11:43 AST).

[40] See: World Gold Council (WGC) (2017)

How much gold has been mined? World Gold Council. URL:

https://www.gold.org/about-gold/gold-supply/gold-mining/how-much-gold (accessed

12/11/2018).

[41] Image: NJB (2018) Money (1).

[42] See: JM Bullion (2015) How Much Fine

Silver Bullion is in the World? JM Bullion. URL:

https://www.jmbullion.com/investing-guide/types-physical-metals/how-much-fine-silver-bullion-in-world/

(accessed 11/12/2018).

[43] See: Global Security (2000-2018) How

Much is That in Real Money? GlobalSecurity.org. URL:

https://www.globalsecurity.org/military/world/spqr/money-1.htm (accessed

12/11/2018).

[44] See: Denarius (Wikipedia

article). URL: https://en.wikipedia.org/wiki/Denarius (accessed 12/11/2018

12:03 PM).

[45] See: Mask of Tutankhamun (Wikipedia

article). URL: https://en.wikipedia.org/wiki/Mask_of_Tutankhamun (accessed

22/11/2018 13:18 AST).

[46] Image source: Since January 1, 2016

it is possible again to take photographs in the Egyptian Museum in Cairo. The

funerary mask of Tutankhamun is certainly the most demanded exhibit (CC BY-SA

3.0), uploaded by Roland Unger. URL:

commons/2/27/CairoEgMuseumTaaMaskMostlyPhotographed.jpg (accessed 22/11/2018).

For more on the license, see: https://creativecommons.org/licenses/by-sa/3.0/

(accessed 22/11/2018).

[47] See: Coin (Wikipedia article).

URL: https://en.wikipedia.org/wiki/Coin (accessed 12/11/2018 07:49 AST).

[48] See: Coin (Wikipedia article).

[49] Image source: Gold Croeseid, minted

by king Croesus circa 561-546 BCE. (10.7 grams, Sardis mint), Classical

Numismatic Group, Inc. http://www.cngcoins.com (CC BY-SA 3.0). Public domain.

URL:

https://upload.wikimedia.org/wikipedia/commons/b/b8/Achaemenid_coin_daric_420BC_front.jpg

(accessed 22/11/2018). For more on the license, see:

https://creativecommons.org/licenses/by-sa/3.0/ (accessed 22/11/2018).

[50] See: Ancient Greek Coinage (Wikipedia

article). URL: https://en.wikipedia.org/wiki/Coin (accessed 12/11/2018

07:59 AST).

[51] See: Mark (2012) Tales From

Herodotus XIV. Two Stories of the Alcmaeonid Family (translation), posted on

August 17, 2012. URL:

https://metaphrastes.wordpress.com/2012/08/17/tales-from-herodotus-xiv-two-stories-of-the-alcmaeonid-family/

(accessed 13/11/2018).

[52] See: Croesus (Wikipedia article).

URL: https://en.wikipedia.org/wiki/Croesus (accessed 12/11/2018 08:12 AST).

[53] See: Persian daric (Wikipedia article).

URL: https://en.wikipedia.org/wiki/Persian_daric (accessed 12/11/2018 08:14

AST).

[54] See: Achaemenid coinage (Wikipedia

article). URL: https://en.wikipedia.org/wiki/Achaemenid_coinage (accessed

12/11/2018 11:33 AST).

[55] See: Achaemenid coinage (Wikipedia

article).

[56] See: Ancient Chinese coinage (Wikipedia

article). URL: https://en.wikipedia.org/wiki/Achaemenid_coinage (accessed

12/11/2018 11:40 AST).

[57] See: Qin (state) (Wikipedia article).

URL: https://en.wikipedia.org/wiki/Qin_(state) (accessed 12/11/2018 11:45 AST).

[58] See: Wu Zhu (Wikipedia article).

URL: https://en.wikipedia.org/wiki/Qin_(state) (accessed 12/11/2018 12:01 PM

AST).

[59] See:

Walter Scheidel (2009) Rome and China: Comparative Perspectives on

Ancient World Empires (Oxford: Oxford University Press), p. 163.

[60] Image source: Type IIIb Achaemenid

Daric, c. 420 BC. Public domain. URL:

https://upload.wikimedia.org/wikipedia/commons/b/b8/Achaemenid_coin_daric_420BC_front.jpg

(accessed 22/11/2018).

[61] See: List of largest empires (Wikipedia

article). URL: https://en.wikipedia.org/wiki/List_of_largest_empires

(accessed 12/11/2018 12:22 PM AST).

[62] See: Achaemenid Empire (Wikipedia

article). URL: https://en.wikipedia.org/wiki/Achaemenid_Empire (accessed

12/11/2018 12:24 PM AST).

[63] See: Han dynasty (Wikipedia article).

URL: https://en.wikipedia.org/wiki/Han_dynasty (accessed 12/11/2018 12:27 PM

AST).

[64] Image: NJB (2018) The Sound Money

Cycle of Growth.

[65] Image: NJB (2018) Government Debt to

Collapse of Civilization.

[66] See: Christopher Weber (2018) A

Short History of International Currencies, Weber

Global Opportunities p. 3. URL:

http://www.weberglobal.net/Historyofmoneycompleter.pdf (accessed 20/11/2018).

[67] See: Richard Henry Timberlake, Kevin

Dowd (2017) Money and the Nation State:

The Financial Revolution, Government and the World Monetary System (London:

Taylor and Francis), p. 26.

[68] See: Timberlake, Dowd (2017), p. 26.

[69] See: Zachary A. Goldfarb (2014) Who

was the richest man in all of history? The Washington Post, April 1,

2014. URL:

https://www.washingtonpost.com/news/wonk/wp/2014/02/19/who-was-the-richest-man-in-all-of-history/?noredirect=on&utm_term=.b706e1e51b0d

(accessed 13/11/2018).

[70] Image source: Bust of Marcus

Licinius Crassus located in the Louvre, Paris, uploaded by cjh1452000 (own

work). Public domain. URL:

https://upload.wikimedia.org/wikipedia/commons/c/cc/Marcus_Licinius_Crassus_Louvre.jpg

(accessed 22/11/2018).

[71] See: Roman Empire (Wikipedia article).

URL: https://en.wikipedia.org/wiki/Roman_Empire (accessed 14/11/2018 07:32

AST).

[72] See: Brilliant Maps (2015) Roman